👋 Welcome, Watt Wizards!

This week’s energy story writes itself: the US just notched a record quarter in utility‑scale storage as batteries step in for peak demand, Europe keeps pulling capital with clearer signals, and global BESS is firing on all cylinders with a 54% YoY surge.

Add a dose of realism: EU solar is set for a brief dip in 2025, which only strengthens the case for grid upgrades, smarter curtailment rules, and storage pairing across portfolios.

🔦 Today’s Highlights:

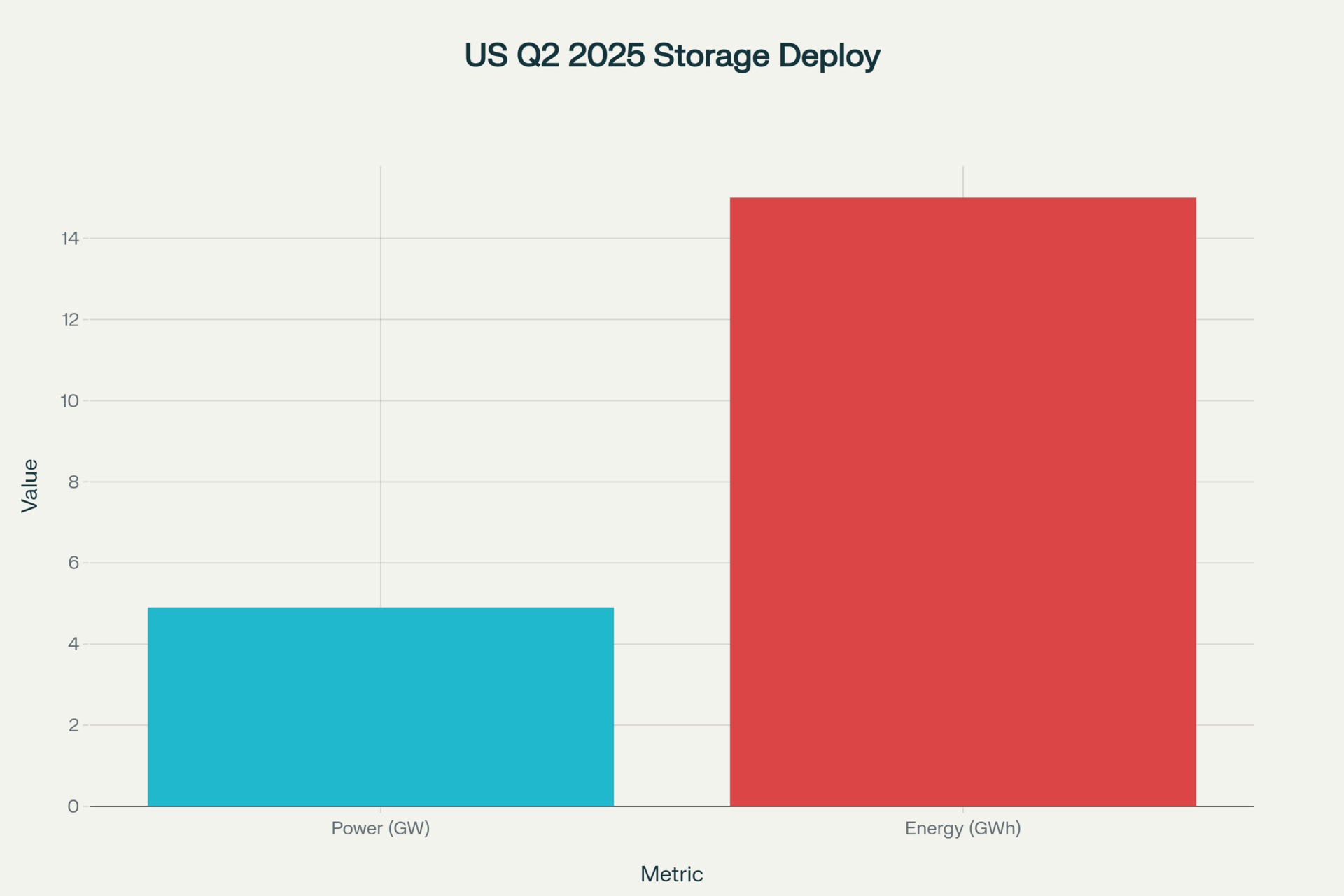

US utility-scale storage hits 4.9 GW/15 GWh in Q2 2025, a quarterly record (+63% YoY)

Global BESS deployments are up 54% year-to-date with 86.7 GWh installed and >412 GWh in the 2025 pipeline.

Europe’s hydrogen ecosystem convenes in Brussels during European Hydrogen Week (Sep 29–Oct 3).

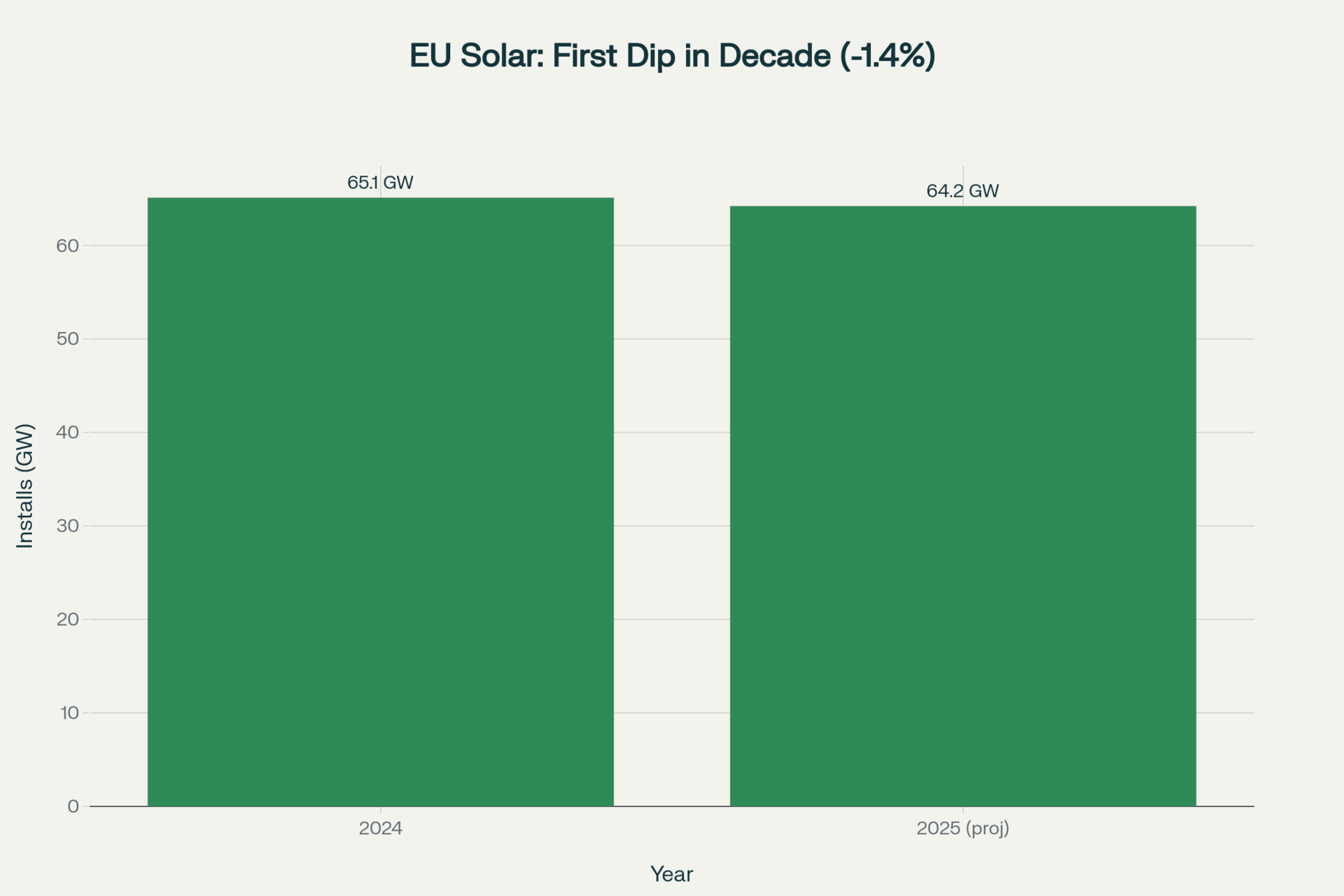

EU solar faces its first projected market dip in a decade in 2025, putting the 2030 trajectory under scrutiny.

📊 Quick Metrics Dashboard

Metric | Value | Change |

|---|---|---|

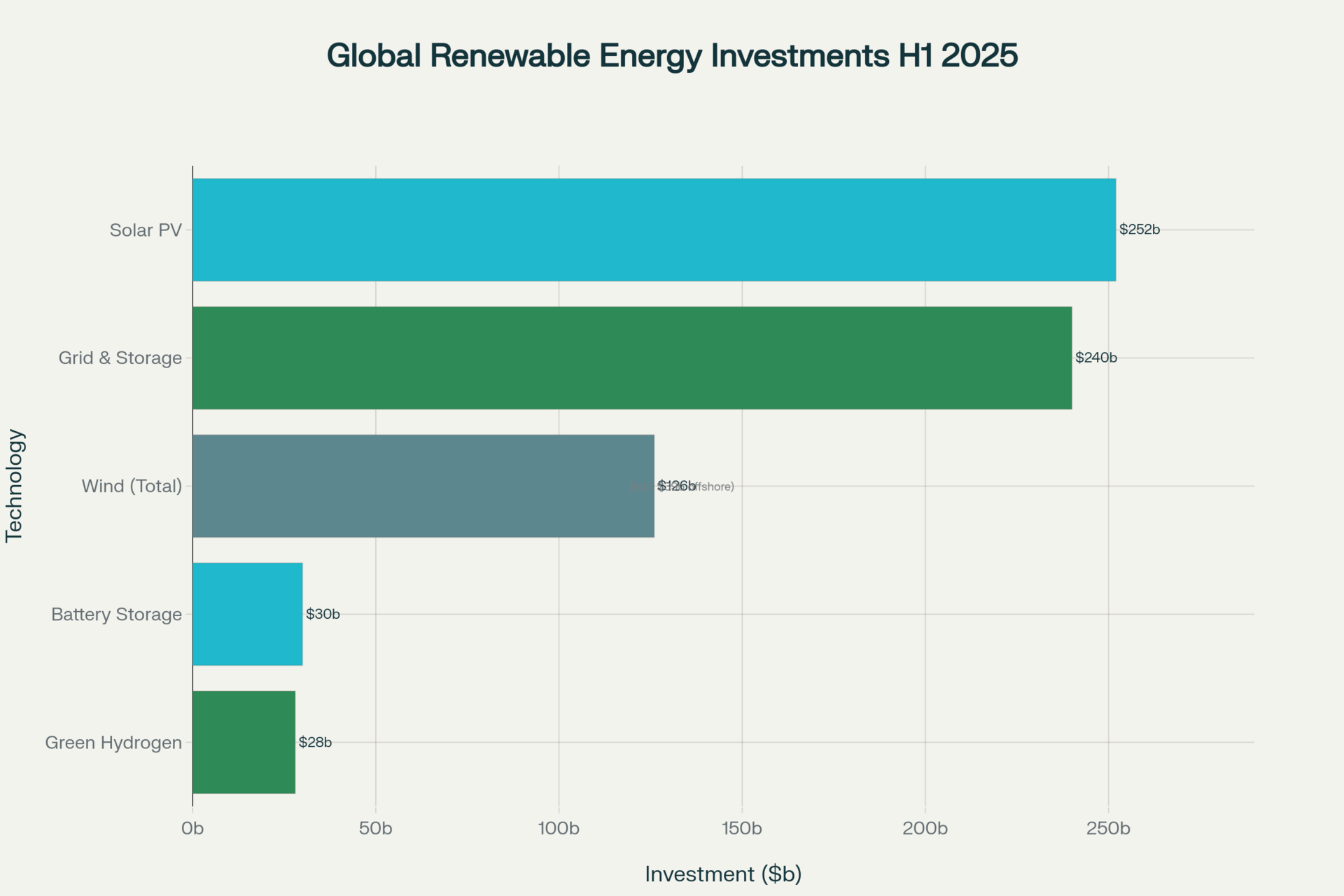

Global RE investment (H1 2025) | $386B | Up YoY |

EU RE investment growth (H1 2025) | +63% | vs H2 2024 |

US RE investment change (H1 2025) | -36% | vs H2 2024 |

Global BESS deployed (H1 2025) | 86.7 GWh | +54% YoY |

US utility-scale storage (Q2 2025) | 4.9 GW / 15 GWh | +63% YoY |

EU solar installs 2025 (proj.) | 64.2 GW | -1.4% YoY |

European Hydrogen Week | Sep 29–Oct 3, Brussels | Ongoing |

Global Renewable Energy Investment by Technology (H1 2025)

📈 What’s Trending

EU solar’s first dip in a decade

Residential softness in key member states and grid bottlenecks point to a -1.4% dip in 2025, even as cumulative EU capacity passes 400 GW and June marked solar’s first month atop the generation stack.

The strategic takeaway: portfolios with interconnection and curtailment resilience will outperform headline market growth in the next 12–18 months.

EU Solar Installations: 2024 vs 2025 (Projected)

Why It Matters ?

Capital follows certainty: transparent auction design, grid upgrades, and clear sourcing rules remain the trifecta for attracting low-cost capital.

Don’t fear the dip: EU solar’s pause is cyclical, not structural—smart queue management and storage pairing should reset momentum for 2026.

🚨 Risk Box

US: tightening “foreign entities of concern” and tariff overhang can slow procurement and reprice pipelines if guidance shifts.

EU: curtailment and interconnection drag risk undercutting rooftop economics and timelines without targeted grid relief.

Sources: Utilitydrive, SolarPowerEruope

🏗️ Projects

US storage’s record quarter—where the megawatts landed

4.9 GW utility-scale added within a 5.6 GW all-segment total, with Texas, California, and Arizona each exceeding 1 GW as utilities lean on batteries for peak and resource adequacy.

Behind the headline, the Southeast is stepping up—Florida and Georgia received major forecast upgrades as vertically integrated utilities accelerate procurement.

Major Project Spotlight:

Poland's Baltic Breakthrough: Three major offshore projects secured €22 billion, including Poland's largest-ever private investment

Estonia's Saare-Liivi: 1.2 GW capacity targeting 2033 completion with €25 million EU support

Spain's Andalusian Valley: €3 billion green hydrogen project featuring 2 GW electrolysis capacity

US Utility-Scale Storage Deployments (Q2 2025)

Why It Matters:

Reliability economics: capacity, fast frequency response, and grid-forming services are now standard in bankable models—not add-ons.

Interconnection is strategy: projects with firm queue positions and substation-readiness command premium pricing and faster CODs.

🚨 Risk Box

Sources: EnergyStorage, Utilitydrive

🤝 Mergers & Acquitsion

Strategic Battery Alliances Reshape Energy Storage

The battery sector is witnessing unprecedented consolidation as companies race to secure supply chains and technological advantages. This week's developments signal a fundamental shift toward vertical integration and strategic partnerships.

Key Developments:

Copenhagen Infrastructure Partners acquired 70% stake in H2Apex's 100 MW German hydrogen project for €167 million

Volkswagen-QuantumScape expanded their solid-state battery partnership, targeting 2029 commercialization with 980 QSE-5 cells per motorcycle prototype

CATL European Push: Unveiled "Shenxing Pro" LFP batteries specifically for European markets, promising 758 km range and 10-minute charging

Technology Convergence:

Partnership | Technology Focus | Commercial Timeline |

|---|---|---|

VW-QuantumScape | Solid-state batteries | 2029 |

CATL-European OEMs | LFP optimization | 2025-2026 |

CIP-H2Apex | Hydrogen integration | 2028 |

Why It Matters ?

Supply Chain Security: European companies are diversifying beyond Asian battery suppliers through strategic partnerships

Technology Leapfrogging: Solid-state batteries promise 40% higher energy density and safer thermal profiles

Market Positioning: These alliances position European players to compete with Chinese battery dominance

🚨 Risk Box: Solid-state battery commercialization faces technical hurdles and manufacturing scalability challenges. Production costs remain 3x higher than conventional lithium-ion, potentially limiting mass adoption before 2030.

Sources: Battery Tech Online, Electrive, Westwood Energy

🚀 Innovation

Hydrogen’s Brussels moment !

European Hydrogen Week is where policy meets steel, with the EU Hydrogen Innovation Forum centring start-ups and scale-ups—exactly where bankable off take needs fresh pathways.

Sessions are zeroing in on funding synergies to bridge valley-of-death phases, aligning CEF, national, and regional programs for faster closing on hydrogen valleys.

Why it matters ?

De-risk with design: synchronising port infrastructure, backbone pipelines, and certification frameworks makes off-take bankable.

Compete on total cost: alignment across funding and permitting can narrow the gap with lower-cost global producers.

🚨 Risk Box:

Policy without pipes: subsidies alone cannot outrun missing transmission, port capacity, and permitting throughput.

Sources: European Hydrogen Week

📚 Interesting Reads

⚠️ US outlook: installations won’t surpass 2025 levels again until 2029 as policy frictions bite—plan procurement, not panic. Source: Energy-Storage.news

🇪🇺 Hydrogen momentum builder: EU Hydrogen Week agenda highlights funding synergies to bridge the “valley of death.” Source: CINEA event page

🗺️ US storage monitor (quick skim): 5.6 GW all-segment record in Q2; Southeast and SPP show fresh life; pipeline seen at 87.8 GW by 2029. Source: ACP/WoodMac report hub

🧭 Investment shift: capital reweights toward EU on policy certainty and infrastructure focus—how portfolios are adapting. Source: IO+ analysis

🧪 Project reality check: EU solar narrative in context—why a slight 2025 contraction doesn’t derail 2030, and what to fix now. Source: Energy Institute summary (SPE analysis)