👋 Welcome, Watt Wizards!

If you thought this week's renewable energy headlines couldn't get any hotter, you clearly haven't been tracking the investment flows shifting across the Atlantic! From Europe's offshore wind surge to the US policy uncertainty causing capital flight, September has delivered more plot twists than a Netflix energy thriller.

Let's dive into the trends, projects, and innovations shaping tomorrow's energy landscape!

🔦 Today’s Highlights:

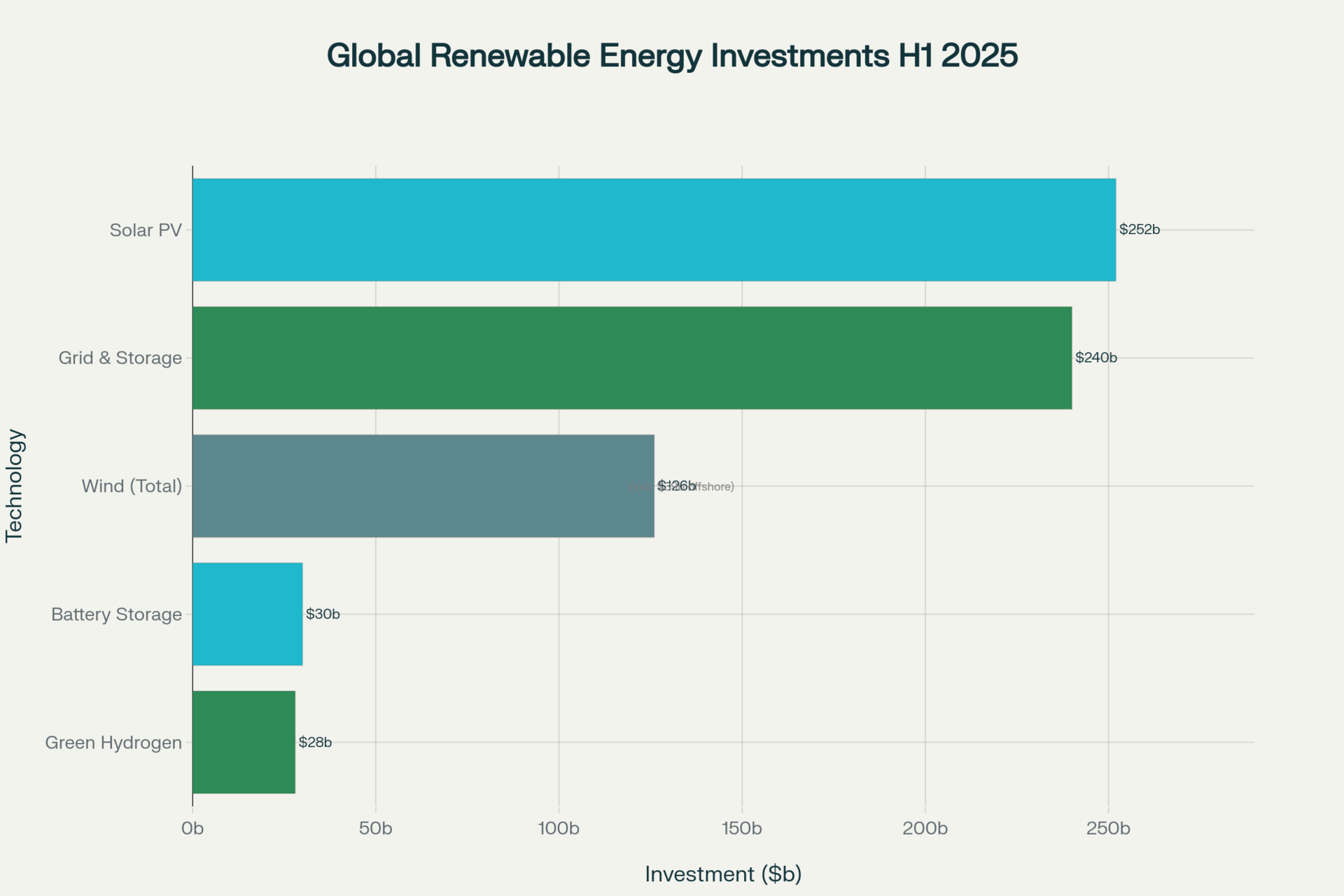

🚀 Record Breaking: Global renewable investments hit $386B in H1 2025 (+10% YoY)

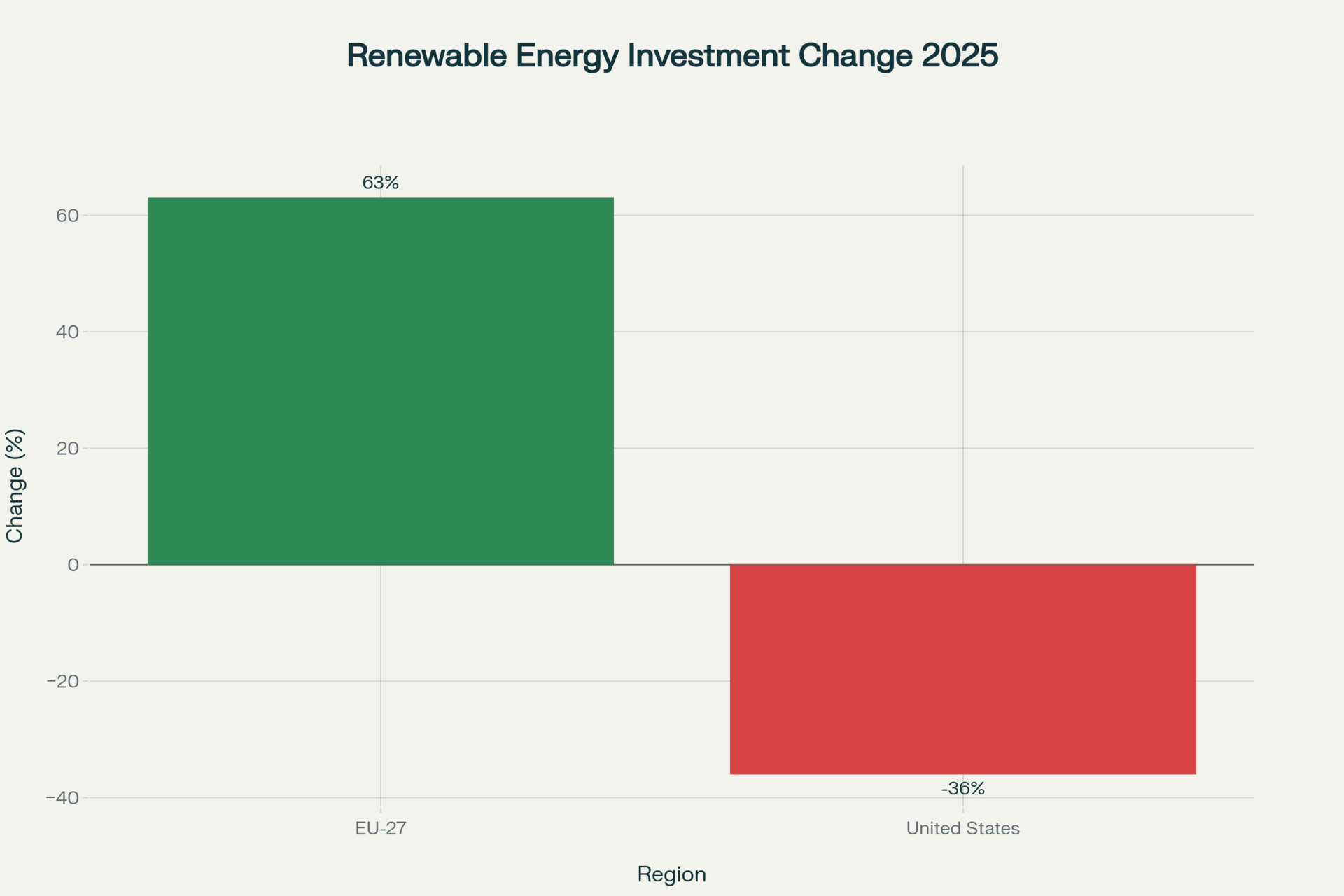

🌊 Capital Migration: EU investments surge 63% while US drops 36% - the great energy exodus is real

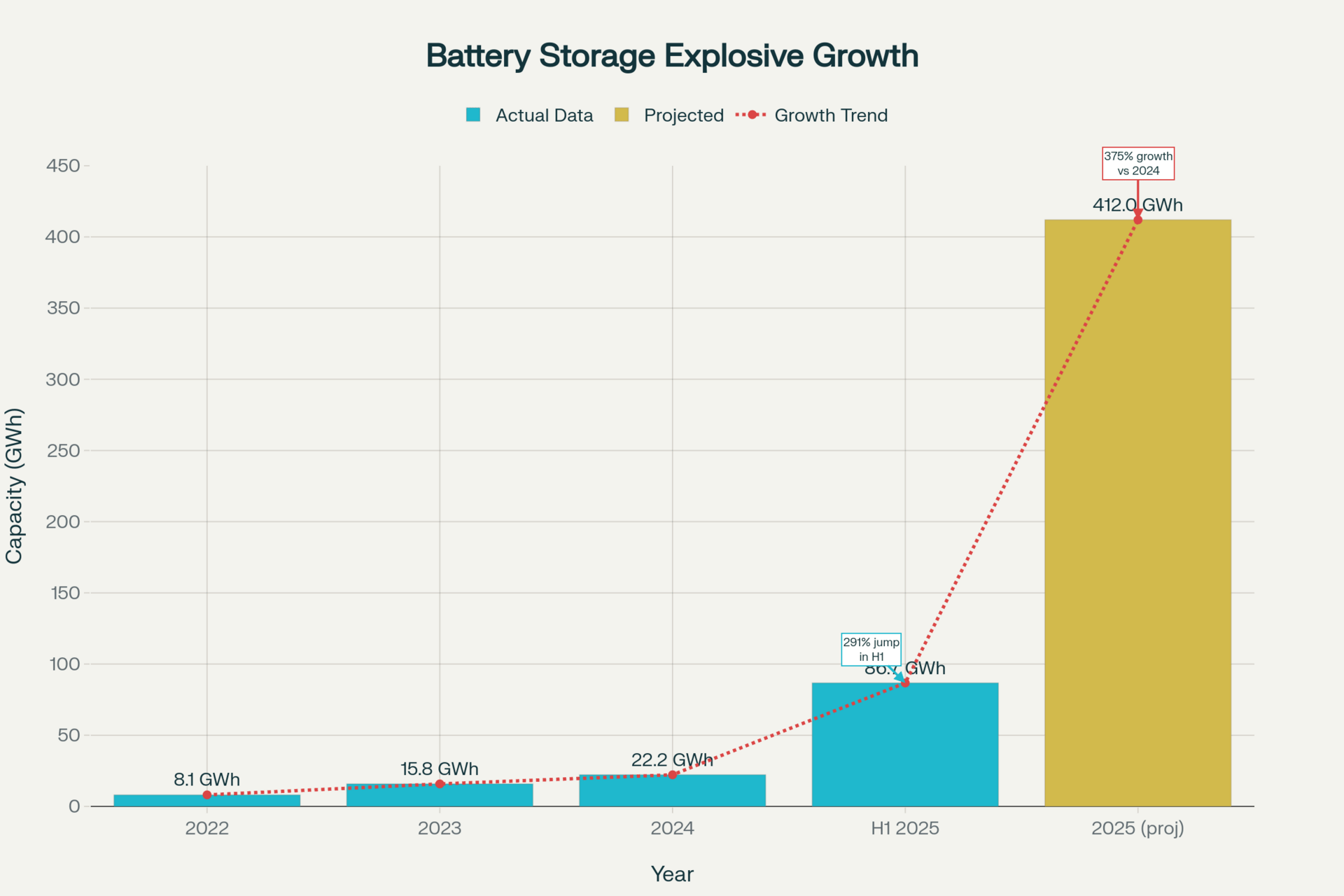

⚡ Battery Boom: Energy storage deployment skyrockets 54% with 86.7 GWh installed globally

💨 Wind Woes: Europe's wind deployment misses targets despite record project financing

💚 Hydrogen Hurdles: Major EU projects withdraw from auctions, leaving €600M unused

📊 Quick Metrics Dashboard

Metric | Value | Change |

|---|---|---|

Global RE Investment (H1 2025) | $386B | ↑ 10% YoY |

EU RE Investment Growth | +63% | ↑ vs H2 2024 |

US RE Investment Change | -36% | ↓ vs H2 2024 |

Battery Storage Deployment (H1 2025) | 86.7 GWh | ↑ 54% YoY |

European Wind Capacity Added (H1 2025) | 6.8 GW | ↓ vs target |

Global Solar Investment (H1 2025) | $252B | ↑ Record high |

Offshore Wind Investment (H1 2025) | $39B | ↑ vs 2024 total |

Global Renewable Energy Investment by Technology (H1 2025)

📈 What’s Trending

The Great Investment Migration: Europe vs America

The renewable energy investment landscape is experiencing a dramatic continental shift that would make even the most seasoned energy analysts reach for their calculators twice. While global renewable investment hit a record $386 billion in the first half of 2025, the real story lies in the regional reallocation of capital that's reshaping the industry.

Renewable Energy Investment Changes: EU vs US (H1 2025)

Why It Matters ?

Policy Stability Premium: European developers benefit from clearer long-term policy frameworks, while US uncertainty under the Trump administration creates investment headwinds

Offshore Wind Exodus: Major players like TotalEnergies and RWE are publicly redirecting North Sea investments away from US coastal projects

Grid Readiness: Europe's advanced grid integration planning provides better revenue certainty for renewable developers

Currency Hedging: European pension funds like CDPQ are "rebalancing" portfolios from US to European projects

🚨 Risk Box: US renewable sector faces potential policy whiplash as federal funding cuts materialize. The cancellation of $13 billion in green energy funds signals continued volatility for American clean energy developers throughout 2025.

Sources: BloombergNEF, Reuters, European Commission

🏗️ Projects

Europe's Offshore Wind Renaissance

Europe secured a staggering €34 billion in final investment decisions (FIDs) for new wind farms in H1 2025 – already exceeding the entire 2024 total. The continent's offshore sector is experiencing unprecedented momentum, with three massive projects leading the charge.

Major Project Spotlight:

Poland's Baltic Breakthrough: Three major offshore projects secured €22 billion, including Poland's largest-ever private investment

Estonia's Saare-Liivi: 1.2 GW capacity targeting 2033 completion with €25 million EU support

Spain's Andalusian Valley: €3 billion green hydrogen project featuring 2 GW electrolysis capacity

By the Numbers:

Project Type | Investment (€B) | Capacity (GW) | Timeline |

|---|---|---|---|

Polish Offshore Wind | 22.0 | 3.5 | 2028-2030 |

Estonian Offshore | 25.0 | 1.2 | 2033 |

Spanish Green H2 | 3.0 | 2.0 | 2025-2027 |

Why It Matters:

Supply Chain Localization: Projects emphasize European manufacturing and component sourcing, boosting regional industrial competitiveness

Grid Integration: Advanced interconnection planning reduces curtailment risks that plague other markets

Jobs Creation: Each new turbine contributes €16 million to European GDP while supporting 400,000 existing wind jobs

🚨 Risk Box: Grid connection bottlenecks remain Europe's Achilles heel. Despite record project approvals, inadequate transmission infrastructure could delay 20% of planned capacity additions beyond 2030.

Sources: WindEurope, European Commission CEF Energy

🤝 Mergers & Acquitsion

Strategic Battery Alliances Reshape Energy Storage

The battery sector is witnessing unprecedented consolidation as companies race to secure supply chains and technological advantages. This week's developments signal a fundamental shift toward vertical integration and strategic partnerships.

Key Developments:

Copenhagen Infrastructure Partners acquired 70% stake in H2Apex's 100 MW German hydrogen project for €167 million

Volkswagen-QuantumScape expanded their solid-state battery partnership, targeting 2029 commercialization with 980 QSE-5 cells per motorcycle prototype

CATL European Push: Unveiled "Shenxing Pro" LFP batteries specifically for European markets, promising 758 km range and 10-minute charging

Technology Convergence:

Partnership | Technology Focus | Commercial Timeline |

|---|---|---|

VW-QuantumScape | Solid-state batteries | 2029 |

CATL-European OEMs | LFP optimization | 2025-2026 |

CIP-H2Apex | Hydrogen integration | 2028 |

Why It Matters ?

Supply Chain Security: European companies are diversifying beyond Asian battery suppliers through strategic partnerships

Technology Leapfrogging: Solid-state batteries promise 40% higher energy density and safer thermal profiles

Market Positioning: These alliances position European players to compete with Chinese battery dominance

🚨 Risk Box: Solid-state battery commercialization faces technical hurdles and manufacturing scalability challenges. Production costs remain 3x higher than conventional lithium-ion, potentially limiting mass adoption before 2030.

Sources: Battery Tech Online, Electrive, Westwood Energy

🔍 Technology Watch

Battery Storage Revolution: The 412 GWh Target

The global battery energy storage system (BESS) market is experiencing explosive growth that's redefining grid stability and renewable integration. With 86.7 GWh already deployed in H1 2025 (a 54% year-over-year increase), the sector is on track to hit an unprecedented 412 GWh by year-end.

Battery Storage's Exponential Acceleration (2022-2025)

European Market Transformation:

The European residential battery market has undergone dramatic cost reductions, with prices dropping 50% from €1,332/kWh in H1 2023 to €711/kWh by H2 2025. This price erosion, driven by lithium cost declines and increased competition, is democratizing energy storage access across the continent.

Technology Breakthroughs:

Sodium-Ion Momentum: China's push for alternative chemistries with 200+ companies entering the sector

Second-Life Applications: Over 200,000 EV batteries reaching end-of-life annually create stationary storage opportunities

Grid-Scale Dominance: Utility-scale systems account for 60% of global installations, focusing on grid stabilization

Regional Performance:

Region | H1 2025 Growth | Key Drivers |

|---|---|---|

Asia-Pacific | 44% share | China manufacturing scale |

Europe | 63% investment growth | Grid integration needs |

North America | -36% investment | Policy uncertainty |

Why It Matters ?

Grid Flexibility: BESS enables higher renewable penetration by solving intermittency challenges

Price Arbitrage: European storage systems generate €17,800 per MW through market participation

Industrial Decoupling: Domestic battery production reduces strategic dependence on Asian suppliers

🚨 Risk Box: Lithium price volatility remains the sector's biggest threat. Despite recent declines, raw material costs could spike 500% during supply disruptions, jeopardizing project economics and deployment timelines.

Sources: PV Magazine, EUPD Research, Market Growth Reports

🚀 Innovation

Green Hydrogen: Promise vs Reality

Green hydrogen's journey from renewable darling to market reality hit significant turbulence this month, as half of Europe's auction-backed projects withdrew from the European Hydrogen Bank's second round, leaving €600 million in subsidies unused.

Project Withdrawals Signal Deeper Issues:

Seven projects totaling 1.88 GW of electrolyzer capacity abandoned their development plans, citing policy delays, infrastructure uncertainty, and completion guarantee challenges. The most significant casualty was the Netherlands' 560 MW Zeevonk electrolyzer, which would have produced 411,000 tonnes over ten years.

Global Scale Contradiction:

While European projects struggle, China is rapidly scaling production. Envision Energy's 2.5 GW Chifeng facility became operational, producing 320,000 tonnes of green ammonia annually with sub-$700/tonne pricing targeting European markets.

Innovation Highlights:

Industrial Integration: Statkraft's 400 MW Shetland project combines wind power with ammonia production for marine applications

Data Center Applications: Rolls-Royce partners with Ineratec to supply hydrogen-based e-diesel for backup power

Cost Competitiveness: India's SIGHT auction achieved record-low pricing at $640/tonne, approaching grey ammonia parity

Market Dynamics:

Region | Production Cost ($/tonne) | Key Advantage |

|---|---|---|

China | <$700 | Scale & integration |

India | $640 | Low renewable costs |

Europe | >$1,100 | Technology leadership |

Why It Matters:

Industrial Transformation: Green hydrogen enables steel, cement, and chemical sector decarbonization

Energy Security: Domestic production reduces dependence on fossil fuel imports

Export Opportunities: Countries with abundant renewables can become hydrogen exporters

🚨 Risk Box: European hydrogen projects face a competitiveness crisis. Without significant policy support or technological breakthroughs, the region risks becoming a net importer of hydrogen from lower-cost Asian and Middle Eastern producers.

Sources: Balkan Green Energy News

📚 Interesting Reads

1. CATL Presents New LFP Battery Technology

Link: https://battery-news.de/en/2025/09/09/catl-presents-new-lfp-battery-technology/

Why Read: CATL's "Shenxing Pro" promises 758km range with 10-minute charging - a potential game-changer for European EV adoption and grid storage applications.

2. Volkswagen's Battery Advances: Unified Cell Now, Solid-State Soon

Link: https://www.electrive.com/2025/09/09/volkswagens-battery-advances-standard-cell-now-solid-state-technology-soon/

Why Read: Detailed technical breakdown of VW's QuantumScape partnership and timeline for 2029 solid-state commercialization.

3. Worldwide Battery Storage Installations Up 54% in First Half of 2025

Link: https://www.pv-magazine.com/2025/07/15/worldwide-battery-storage-installations-up-54-in-first-half-of-2025-june-sets-monthly-record/

Why Read: The source for our explosive growth data - incredible insights into which regions are driving the battery boom.

4. European Governments Must Get Their Act Together on Wind Energy

Link: https://windeurope.org/news/european-governments-must-get-their-act-together-on-wind-energy/

Why Read: WindEurope's frank assessment of Europe's permitting crisis and why 400,000 jobs depend on solving it quickly.

5. Latest Wind Energy Data for Europe: Autumn 2025

Link: https://windeurope.org/data/products/latest-wind-energy-data-for-europe-autumn-2025/

Why Read: Fresh data showing Europe added 6.8 GW of wind in H1 2025 - but fell short of what's needed for climate goals.

6. Half of EU Auction-Backed Hydrogen Projects Pull Out

Link: https://balkangreenenergynews.com/half-of-eu-auction-backed-hydrogen-projects-pull-out/

Why Read: Critical analysis of why €600M in EU hydrogen subsidies went unused - a sobering reality check for the sector.

7. Moeve Readies for Construction of Spain's Largest Green Hydrogen Project

Link: https://hydrogeneurope.eu/moeve-readies-for-construction-of-spains-largest-green-hydrogen-project/

Why Read: One success story amid the struggles - how Spain's €3B Andalusian Valley project is actually moving forward.

8. What We Learnt This Summer About Green Hydrogen and Ammonia Prices

Link: http://gh2.org/what-we-learnt-summer-about-green-hydrogen-and-ammonia-prices-and-production

Why Read: Essential pricing intelligence showing how China's scale is crushing European competitiveness.

9. Global Renewable Energy Investment Still Reaches New Record

Link: https://about.bnef.com/insights/clean-energy/global-renewable-energy-investment-reaches-new-record-as-investors-reassess-risks/

Why Read: BloombergNEF's comprehensive breakdown of the $386B H1 2025 investment surge and regional shifts.