👋 Welcome, Watt Wizards!

As the world accelerates toward a sustainable future, staying ahead of the curve in renewables isn't just smart—it's essential. In this edition of Renewable Insights, we're unpacking the hottest developments from the past week, blending cutting-edge tech with real-world impacts across Europe, the Middle East, Asia, and beyond.

Whether you're an investor spotting opportunities in wind surges or an enthusiast exploring AI's role in grid optimization, we've curated insights to fuel your journey.

Let's dive into the trends, projects, and innovations shaping tomorrow's energy landscape!

🔦 Today’s Highlights:

🌊 Europe doubles down on offshore wind with new policy tools and fresh FIDs to steady costs and speed grids.

🔋 Batteries lock in financeable models: PJM’s largest project closes funding as UK capacity keeps climbing.

🤝 Major deal between Indonesia and Dutch innovators for renewable tech transfer.

🎥 A new documentary highlighting paths to clean energy transitions.

🔋 Top trends like decarbonisation and AI's role in energy demands.

📈 What’s Trending

Understanding Wind: Changes and Reasons

Europe is transitioning from setting ambitious headline targets to implementing practical execution strategies by integrating new investment decisions with "tripartite contracts." These contracts are designed to align auctions, power purchase agreements (PPAs), and grid build-out efforts, thereby stabilizing the economics and timelines of renewable energy projects. This strategic approach is exemplified by six offshore wind final investment decisions (FIDs) that collectively represent an investment of approximately €22 billion.

These projects are expected to generate between 5.6 and 6.0 gigawatts of power, indicating a renewed sense of capital confidence in the sector. However, the successful delivery of these projects by their commercial operation dates (CODs) between 2026 and 2028 is still heavily dependent on overcoming critical challenges related to cables, ports, and interconnections.

Simultaneously, the actual delivery of these projects in the real world remains contingent upon their resilience to unforeseen challenges. For instance, France's EFGL floating wind farm has successfully completed the installation of its turbines, marking a significant milestone in its development. In contrast,

Highlight | Metric | Where | Status |

|---|---|---|---|

New EU offshore FIDs | ~6 GW and €22B committed | Europe | FID announced |

EFGL floating wind | 30 MW installed | France | Turbines in place |

Why it matters ?

Lower capital costs and faster grid connections are now the decisive levers for offshore wind delivery and OEM health, not just auction volumes.

Floating milestones boost confidence for deeper-water markets, while Asia’s delays are a reminder to over-diligence cables, ports, and interconnections in schedules and budgets.

Actionable: Favor CfD-style auctions over negative bidding, pre-validate grid timelines, and track port/vessel bottlenecks to protect IRR and COD certainty.

Sources — WindEurope

🏗️ Projects

Practical Aspects of Battery Reliability and Size

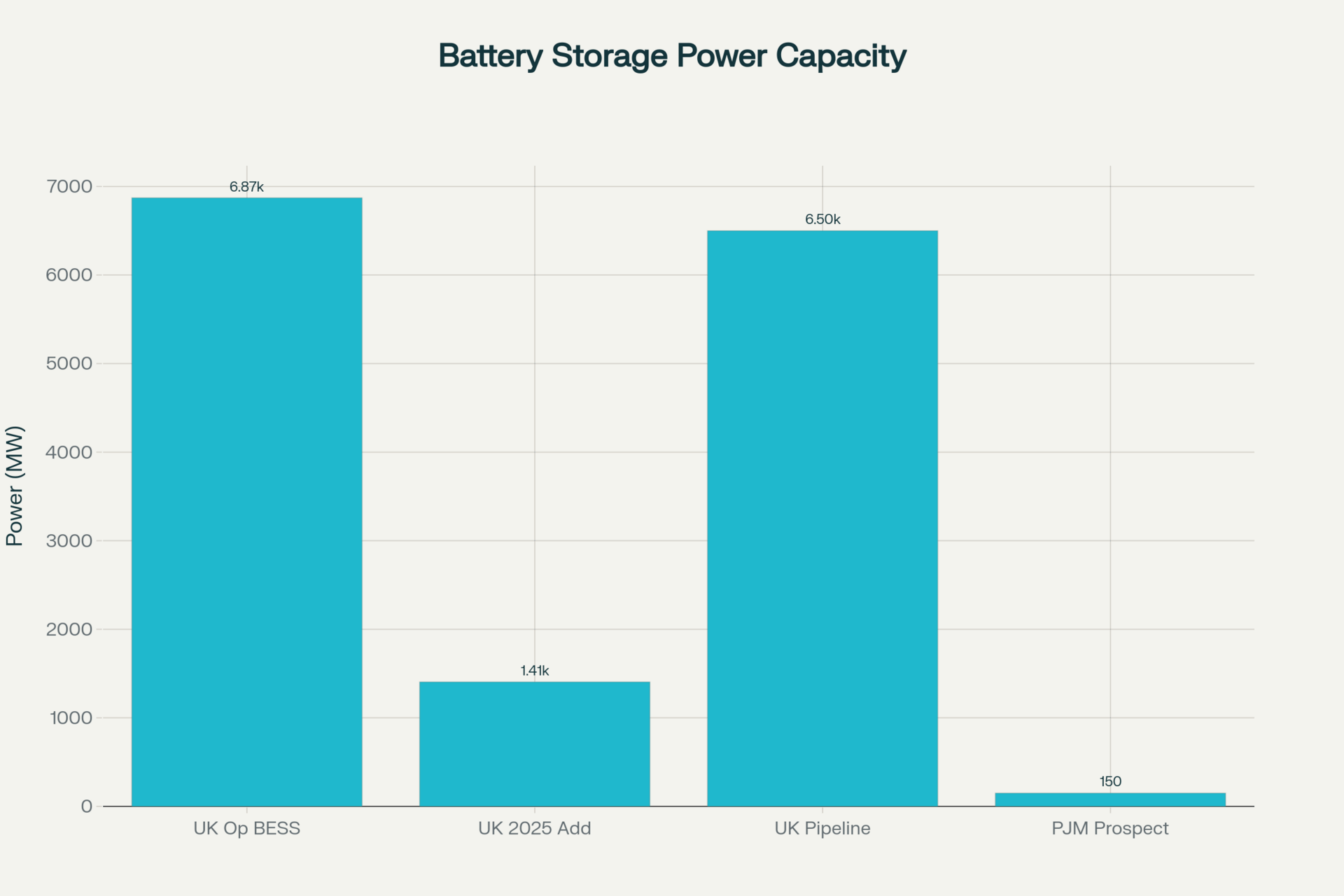

The financing landscape within the energy sector is experiencing a profound transformation, transitioning from initial pilot initiatives to more extensive, programmatic strategies. An illustrative case of this evolution is Swift Current Energy's recent success in obtaining $242 million in financing for the development of the largest Battery Energy Storage System (BESS) within the PJM Interconnection, a regional transmission organization in the United States. This project, with a capacity of 150 megawatts (MW) and 600 megawatt-hours (MWh), is supported by a 15-year offtake agreement.

This development establishes a new standard for creating long-term, contracted revenue streams from storage solutions in U.S. energy markets, reflecting an increasing confidence in the financial viability and strategic significance of such projects. Concurrently, in the United Kingdom, the operational capacity of Battery Energy Storage Systems has reached a notable 6.872.

Grid battery storage metrics (power, MW)

Why it matters ?

Contracted cores with merchant add-ons reduce cash flow volatility and improve debt terms for storage, accelerating build-out in mature grids.

Two to four hours is emerging as the sweet spot for grid value in wind/solar-heavy regions, improving peak coverage and curtailment outcomes at scale.

Actionable: Prioritize interconnection-ready substations, proven safety records, and standardized controls to compress COD timelines and insurance costs.

Potential Threat :

Thermal runaway concerns and tightening insurance can erode IRRs; interconnection queues and local siting push schedules right even for well-structured.

Sources Renewableuk, energy-storage.

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

🤝 Mergers & Acquitsion

In recent days, a particularly noteworthy agreement has emerged between Pertamina NRE, a prominent Indonesian energy company, and the Dutch HyET Group, a leader in renewable energy solutions. This Memorandum of Understanding (MoU) signifies a significant step forward in the realm of renewable energy innovation, with a specific focus on the transfer of technology and the initiation of pilot projects within Indonesia.

Metric | Value |

|---|---|

Potential Investment | $500 million |

CO2 Savings | 1.5 million tons over 5 years |

Why It Matters ?

Drivers: Indonesia's push for energy independence via Dutch expertise.

Challenges: Scaling pilots to commercial levels.

Global Benchmarks: Mirrors Middle East partnerships like UAE's hydrogen deals.

Regional/Geopolitical Context: Enhances Asia's role in global renewables, countering China's dominance.

Risks: Technology transfer delays due to IP issues.

Actionable Takeaways: Engineers, explore hydrogen tech for career growth; investors, watch for commercialization timelines.

Potential Threats

Critiques: Dependency on foreign tech may limit local innovation. Barriers: Regulatory hurdles in emerging markets. Uncertainties: Fluctuating hydrogen market prices.

Sources

Source: Pertamina NRE seals deal with Dutch HyET group on renewable energy innovation – Indonesia Business Post

🔍 Technology Watch

Technology

Wärtsilä's new documentary, which was released this week, provides an in-depth exploration of sustainable energy transitions, highlighting the critical role of flexible technologies such as battery storage systems in maintaining grid stability. The documentary delves into the various ways these technologies are being implemented to support a more resilient and reliable energy infrastructure.

By storing excess energy and releasing it when needed, battery storage systems help balance supply and demand, thereby enhancing the overall efficiency and sustainability of the power grid.

Click on the link below to see the video !!! Nicely articulated.

Metric | Value |

|---|---|

Energy Savings | 50% reduction |

Battery Capacity Growth | 20% YoY |

Why It Matters ?

Drivers: Need for reliable grids amid variable renewables.

Challenges: High costs of advanced batteries.

Global Benchmarks: China's lead in battery tech at 70% market share.

Regional/Geopolitical Context: Middle East adapts tech for desert climates; Europe focuses on urban integration.

Risks: Supply shortages for lithium.

Actionable Takeaways: Enthusiasts, adopt home battery systems; professionals, integrate Wärtsilä models for projects.

🚀 Innovation

Top innovations from the past week include AI's expanding role in energy trends, with new applications for grid management and forecasting, such as machine learning models predicting biomass power plant output with up to 97% accuracy. Another example is the integration of AI in smart grids for real-time demand response and renewable optimization, highlighted in recent studies on IoE (Internet of Energy) enabling seamless microgrid control.

Exponential growth in big batteries continues, soaking up excess solar and reducing negative pricing, while India's policies are canceling delayed projects to fast-track operational renewables.

Metric | Value |

|---|---|

Battery Growth | 2x increase in capacity |

AI Forecasting Accuracy | Up to 97% (e.g., XGBoost models) |

AI Energy Demand Rise | 30% by 2030 |

Grid Efficiency Gain | 15-20% via AI |

Why It Matters ?

Drivers: AI optimizes variable renewables like solar and wind by forecasting supply/demand and enabling predictive maintenance, reducing downtime by up to 30%.

Challenges: Integrating intermittent sources into grids without AI leads to instability; handling data privacy and cybersecurity in IoE systems.

Global Benchmarks: China leads AI-driven battery tech with 70% market share, while Europe advances IoE for 40% renewable integration.

Regional/Geopolitical Context: In Asia (e.g., India/China), AI counters energy demand spikes from urbanization; Middle East uses it for oil-to-renewable transitions amid geopolitical shifts; emerging markets like Africa benefit from AI for off-grid microgrids.

Risks: Over-reliance on AI could amplify vulnerabilities to cyberattacks or data biases.

Actionable Takeaways: Investors, prioritize AI startups in grid tech for high returns; engineers, implement XGBoost for forecasting in projects; policymakers, fund IoE pilots to boost regional energy security.

Sources :

Source: The top 5 energy technology trends of 2025 – World Economic Forum

📚 Interesting Reads

📜 Policy Challenges and Opportunities for Renewable Energy Development in Nigeria : Explores Nigeria's untapped solar and wind potential, highlighting policy fixes for a sustainable future.

🤖 A Bibliometrics Assessment of AI, IoT, Blockchain, and Big Data in Renewable Energy-Oriented Power Systems : A deep dive into how digital tech is transforming energy grids, with trends from 2020-2025.

💰 Green Finance and Renewable Energy Investments : Compares global successes and barriers in funding clean energy, from China's pilots to Africa's challenges.

💡 Automating Financial Decision-Making in Renewable Energy : How AI and credit models are making sustainable investments smarter and less risky in the US.

🌱 Renewable Energy Policy and Sustainable Development in Nigeria : A scoping review on how policies can directly boost Nigeria's green growth despite regulatory hurdles.

🔌 Integration of Renewable Energy with Thermal-Based Power Systems : Reviews grid stability and storage solutions for hybrid systems, with a focus on lithium-ion dominance.

🌬️ Wind Turbine Research Map: An Overview of Renewable Energy Technology Innovation Trends : Maps out trends in blade design and offshore ops, with clusters on future innovations.

🌴 Unlocking the Potentials of Palm Oil as a Source of Renewable Energy : Examines biodiesel from palm oil, balancing yields with sustainability concerns like deforestation.

📊 Electricity Market Transformation in the Renewable Energy Era : Analyzes how renewables are shaking up markets, reducing prices but increasing volatility.