👋 Welcome, Watt Wizards!

Welcome to a transformative moment in renewable energy where breakthrough technologies meet market realities, and the industry stands at a crucial inflection point.

This edition explores five game-changing developments reshaping our energy future: from 24-hour solar becoming cost-competitive with fossil fuels, to China's offshore wind dominance, and the emergence of revolutionary battery and hydrogen technologies that promise to unlock unprecedented scale and efficiency.

Ready to discover what’s shaking up the future of energy?

🔦 Today’s Highlights:

⚡ 24-Hour Solar Breaks the $100/MWh Barrier

🌊 China Commands Half the World's Offshore Wind

🇩🇪 Germany's Renewable Reality Check

🔋 Solid-State Batteries Go Commercial

🧠 Bonus Section

🔥 What's Trending

24-Hour Solar Power Reaches Commercial Reality

The renewable energy sector has achieved a milestone that seemed impossible just years ago: round-the-clock solar electricity is now economically viable. Advanced battery storage systems can now deliver continuous solar power 97% of the time at $104 per megawatt-hour (MWh) in sunny locations like Las Vegas—22% cheaper than just a year ago and more cost-effective than new coal ($118/MWh) or nuclear ($182/MWh) plants.

Metric | 2024 | 2025 | Change |

|---|---|---|---|

24-Hour Solar Cost ($/MWh) | $132 | $104 | -22% |

Battery Market Growth | $4.91B | $6.6B | +34.4% |

Global Solar Additions | 495 GW | 493 GW | -0.4% |

Why It Matters:

Game-changing economics: Solar + storage now undercuts fossil fuels in multiple markets, accelerating deployment beyond just sunny hours.

Industrial transformation: Data centers and heavy industries can now secure 24/7 clean energy contracts, reshaping corporate procurement strategies.

Grid revolution: Five times more solar capacity can be installed behind existing grid connections, maximizing infrastructure investments.

Global competitiveness: Countries with abundant sunshine gain significant economic advantages in energy-intensive manufacturing.

Investment surge: Private equity and infrastructure funds are pivoting toward proven storage technologies with predictable returns.

Risk Box: While promising, 24-hour solar faces grid integration challenges, requires massive upfront capital, and depends heavily on weather patterns that climate change may alter unpredictably.

🔗 Source - Ember Energy

2.China's Offshore Wind Surge Reshapes Global Energy Geography

China has emerged as the undisputed offshore wind superpower, growing from under 5 GW in 2018 to 42.7 GW by March 2025—representing 50% of global offshore wind capacity. The country added 4.4 GW in 2024 alone, accounting for 55% of all global offshore wind additions, with 67 GW in the development pipeline and 28 GW currently under construction.

Region | Operational Capacity | Pipeline | Key Technology |

|---|---|---|---|

China | 42.7 GW | 67 GW | 16MW turbines, floating platforms |

Europe | ~25 GW | Limited data | Traditional fixed-bottom |

US | ~2.5 GW | Planned expansion | Policy-dependent |

Why It Matters:

Manufacturing dominance: China controls 60% of global wind turbine production, potentially driving down costs worldwide through export expansion.

Decarbonization catalyst: Guangdong Province's 11.4 GW offshore fleet alone avoids 23 million tonnes of CO2 annually.

Technology leadership: Chinese companies are pioneering 16MW turbines and floating platforms for deepwater deployment.

Geopolitical implications: Energy security advantages for coastal provinces consuming nearly half of China's electricity.

Global supply chains: Chinese expertise and cost advantages are reshaping international offshore wind development

Risk Box: Rapid expansion faces grid integration challenges, environmental concerns, and potential overcapacity. Competition from continued coal and gas development threatens offshore wind's market penetration.

🔗 Source - Global Energy Monitor

🏗️ Projects

Germany's Solar Sprint Falls Short of Ambitious Targets

Germany added 8.6 GW of renewable capacity between January and July 2025, with solar contributing 5.4 GW (62% of new installations). Despite this substantial growth, the country remains below the monthly installation rates needed to achieve its 215 GW solar target by 2030—requiring over 105 GW of additional capacity in less than five years.

Technology | Jan-July 2025 | Cumulative | 2030 Target | Gap |

|---|---|---|---|---|

Solar | 5.4 GW | 109 GW | 215 GW | 106 GW |

Onshore Wind | 2.2 GW | Data limited | Higher targets | Significant |

Offshore Wind | 0 GW | 9.2 GW | 30 GW | 20.8 GW |

Why It Matters:

Scalability challenge: Germany's experience reveals the massive infrastructure and permitting acceleration needed for gigascale renewable deployments.

Technology mix optimization: Solar dominance (62% of additions) highlights the need for balanced renewable portfolios including wind and storage.

European benchmark: As Europe's largest economy, Germany's progress (or lack thereof) influences continent-wide renewable energy targets.

Investment pipeline: The 106 GW solar gap represents hundreds of billions in potential investment opportunities.

Policy adaptation: Permitting bottlenecks require fundamental regulatory reform to meet climate commitments.

Risk Box: Offshore wind saw zero net growth in 2025, jeopardizing the 30 GW target by 2030. Grid infrastructure limitations and permitting delays could compound shortfalls.

🔗 Source - Strategic Energy

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

🤝 Mergers

Strategic Consolidation Accelerates in Energy Transition Era

Renewable energy M&A activity is expected to strengthen in 2025 as companies seek scale, technological capabilities, and geographic diversification. Vertical mergers and acquisitions have proven particularly effective for enhancing supply chain resilience, with Chinese renewable energy enterprises showing stronger supply chain performance post-M&A compared to non-acquiring counterparts.

M&A Focus | Key Drivers | Investment Scale | Strategic Rationale |

|---|---|---|---|

Renewable Energy | Energy transition demand | Multiple billions globally | Technology integration, scale |

Battery Storage | Grid stability needs | $6.6B market 2025 | Energy storage leadership |

Green Hydrogen | Cost competitiveness | $2.3B India incentives | Future fuel positioning |

Traditional Energy | Extended oil peak to 2034 | Goldman Sachs analysis | Hedging strategies |

Why It Matters:

Supply chain resilience: Vertical integration mitigates supplier concentration risks and enhances operational flexibility.

Technology acceleration: M&A enables rapid deployment of innovations like solid-state batteries and advanced wind turbines.

Geographic expansion: Cross-border deals help companies access new markets and regulatory environments.

Financial optimization: Consolidation improves access to capital markets and reduces development costs.

Competitive positioning: Scale advantages become crucial as renewable technologies mature and margins compress.

Risk Box: Regulatory uncertainty, particularly around environmental policies and tax incentives, creates valuation challenges. Integration complexity and cultural mismatches risk destroying deal value.

🔗 Source - Grant Thornton

⚙️ Technology

⚡ Solid-State Battery Revolution Promises Energy Storage Breakthrough

The commercial scaling of solid-state battery technology represents 2025's most significant energy storage advancement, offering 2-3 times the energy density of conventional lithium-ion batteries while eliminating fire risks associated with liquid electrolytes. These batteries are being developed for applications ranging from electric vehicles to grid-scale energy storage systems.

Technology | Energy Density | Safety Profile | Applications |

|---|---|---|---|

Solid-State | 2-3x lithium-ion | No fire risk | EVs, grid storage, aerospace |

Silicon Anode | +40% capacity | Enhanced | Solar storage systems |

Lithium Iron Phosphate | Standard | High safety | Utility-scale projects |

Why It Matters:

Energy density revolution: Higher capacity in smaller packages enables new applications and reduces installation costs.

Safety transformation: Elimination of fire hazards allows deployment in dense urban environments and sensitive infrastructure.

Grid integration enhancement: Improved performance characteristics support higher renewable energy penetration.

Cost competitiveness: Manufacturing scale-up drives down costs while improving performance metrics.

Innovation acceleration: Breakthrough creates competitive pressure across entire energy storage industry.

Risk Box: Manufacturing complexity and supply chain constraints may limit initial deployment. Early commercial products face performance validation challenges in real-world conditions.

🔗 Source - National Battery Supply

🚀 Innovation

Floating Offshore Wind Unlocks Deepwater Potential

Floating offshore wind technology is rapidly advancing beyond experimental phases, with China leading deployment of 5 operational pilot projects totaling nearly 40 MW and planning a massive 1,000 MW Hainan Wanning floating wind farm with the first 200 MW phase completing by end-2025. These platforms enable access to deeper waters with stronger, more consistent winds while reducing visual impact on coastal communities.

Technology | Current Scale | Planned Scale | Water Depth |

|---|---|---|---|

Semi-submersible | Most Chinese pilots | Dominant design | 50-200m+ |

Semi-spar | Under development | 16MW turbines | 100m+ |

TLP (Tension Leg) | 1 planned in China | Limited | 200m+ |

Why It Matters:

Resource expansion: Floating platforms access 80% of global offshore wind resources in waters deeper than 60 meters.

Technology scaling: 16MW turbine designs maximize energy capture while reducing per-unit installation costs.

Market acceleration: China's manufacturing dominance in floating platforms could drive global cost reductions.

Grid integration benefits: Deepwater locations often coincide with major coastal demand centers.

Environmental advantages: Reduced seabed impact and distance from shore minimize ecological and visual concerns.

Risk Box: Complex engineering requirements increase capital costs and maintenance challenges. Transmission infrastructure to deepwater sites requires massive additional investment.

🔗 Source - Global Energy Monitor

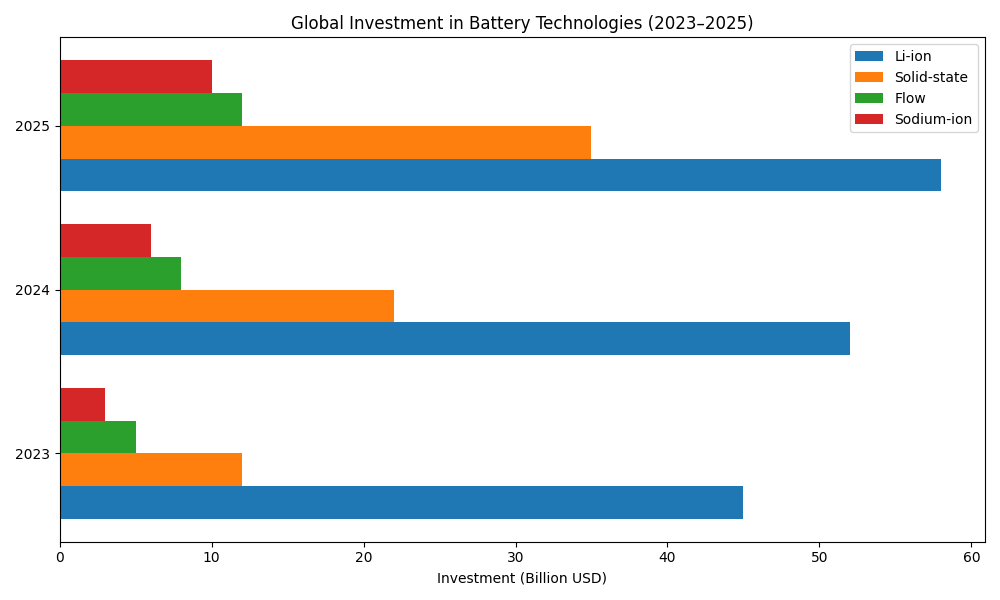

📈 Chart of the Week: Global Investment in Battery Technologies (2023–2025)

🔍 Editor’s Note:

Battery storage has emerged as a prominent feature. This chart tracks global investment across four major battery technologies over the past three years: Li-ion, solid-state, flow, and sodium-ion. While Li-ion remains dominant, solid-state batteries are seeing explosive growth, nearly tripling in investment from $12B in 2023 to $35B in 2025. Flow and sodium-ion technologies are also gaining traction, especially for grid-scale applications and long-duration storage

📚 Interesting Reads

1. Maritime Ports Go Digital 🚢

Smart renewable microgrids transforming port operations and vessel electrification for shipping decarbonization.

Source: MDPI

2. Nuclear-Renewable Partnership ⚛️

Nuclear flexibility enables deeper wind/solar integration through load-following capabilities in French power systems.

Source: Semantic Scholar

3. Texas Emissions Accounting 🌪️

Advanced methodologies for calculating renewable climate benefits using Texas wind farm case studies.

Source: Semantic Scholar

4. Food Waste-to-Energy 🍎

Circular economy innovations converting organic waste into renewable energy through biogas/biofuel systems.

Source: Science Letters

5. Wind Energy Challenges 💨

2025 analysis reveals supply chain constraints, permitting bottlenecks, and grid integration hurdles.

Source: Delfos Energy

6. Next-Gen Solar Batteries 🔋

Perovskite-silicon cells and AI-optimized systems revolutionizing residential/commercial storage.

Source: Kings Research

7. Offshore Wind Safety ⚓

Collision risk models optimizing turbine placement while maintaining safe shipping channels.

Source: World Scientific

8. Gulf Supply Chain Strategy 🏭

MENA developing renewable manufacturing capabilities and tech partnerships reshaping global economics.

Source: Middle East Council

9. European Wind Policy 🇪🇺

Socio-economic analysis of job creation and rural development challenges affecting public acceptance.

Source: MDPI

10. Australia's Hydrogen Race 🇦🇺

Critical timing analysis for competing in global hydrogen markets before opportunities shift elsewhere.

Source: CSIRO