👋 Welcome, Watt Wizards!

In a world racing toward net zero, staying informed isn’t just helpful—it’s essential. This newsletter is your weekly companion through the fast-moving landscape of wind, solar, and energy storage.

Whether you're an investor tracking megatrends, an engineer solving grid challenges, a policymaker shaping the future, or a student dreaming big—you're part of this global energy transition.

In this edition, we spotlight the historic moment when clean energy investment overtook fossil fuels, explore China’s staggering renewable pipeline, unpack Tesla’s battery breakthrough, and trace the rise of floating wind. It’s a mix of optimism, realism, and data curated to help you lead, build, and connect.

Ready to discover what’s shaking up the future of energy?

🔦 Today’s Highlights:

📈 $1.7T in global clean energy investment

🔋 Solid-state batteries edge closer to commercial scale

🌬️ China’s wind and solar pipeline hits 1.3 TW

🤝 $10B Innergex buyout signals investor confidence

🌊 Floating wind deployment surges globally

🧠 Bonus Section

📊 Quick Metrics Dashboard

Metric | Value | Change |

|---|---|---|

Global RE Investment (2025) | $1.7T | +13% YoY |

Solar LCOE | $29/MWh | ↓ 15% YoY |

Wind LCOE | $41/MWh | ↓ 9% YoY |

BESS Global Deployments (H1) | 86.7 GWh | +54% YoY |

🔍 What’s Trending

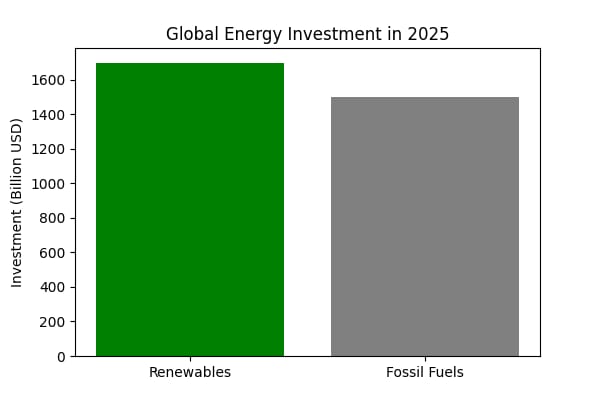

💰 Global Investment Surpasses Fossil Fuels

According to the IEA’s World Energy Investment 2025 report, global energy investment is projected to reach $3.3 trillion this year, with $2.2 trillion flowing into clean energy—marking the first time renewables have overtaken fossil fuels in capital allocation.

This shift is driven by a convergence of factors: post-Ukraine energy security policies, the electrification of AI and data center infrastructure, and aggressive net-zero mandates from corporations and governments alike. The implications are profound: fossil fuel majors are diversifying into renewables, institutional investors are reallocating capital, and grid modernization is becoming a top priority.

However, risks remain. Fossil fuel subsidies are still entrenched in many emerging markets, and grid infrastructure is struggling to keep pace with the rapid growth in generation capacity.

Why It Matters:

Signals a tipping point in capital allocation

Driven by AI, cleantech, and carbon markets

Fossil fuel volatility boosts RE competitiveness

🧨 Risk Box:

Policy reversals in the U.S. could slow deployment

Grid bottlenecks remain a major constraint

🏗️ Projects

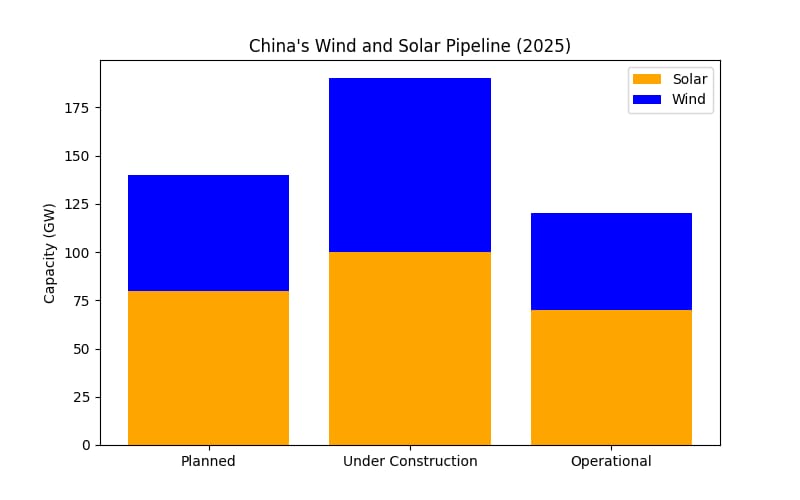

🇨🇳 China’s Pipeline: 1.3 Terawatts and Rising

China continues to dominate the global renewable energy landscape, with a pipeline exceeding 1.3 terawatts of utility-scale solar and wind projects. Of this, 510 GW is already under construction.

Offshore wind capacity has grown from just 5 GW in 2018 to 42.7 GW in 2025, driven by provincial mandates and central government subsidies. China’s dominance in solar manufacturing—accounting for 75% of global output—has helped drive down costs worldwide.

However, this rapid expansion comes with challenges: curtailment due to grid congestion, overcapacity in solar manufacturing, and growing trade tensions with the U.S. and EU. Still, China’s ability to scale both generation and manufacturing remains unmatched.

Why It Matters?

China holds 75% of global solar manufacturing

Offshore wind is key to decarbonizing coastal provinces

Curtailment and grid bottlenecks remain major challenges

🧨 Risk Box:

Overcapacity in solar manufacturing

Trade tensions with U.S. and EU

🤝 Mergers

💼 Innergex Goes Private in $10B Deal

In a major move for the renewable energy sector, Canadian developer Innergex Renewable Energy Inc. has been acquired by La Caisse for $13.75 per share, valuing the company at nearly $10 billion.

The deal includes 92 operating assets and 16 development projects across hydro, wind, solar, and battery storage, totaling 4.9 GW of gross capacity. This acquisition signals strong investor confidence in the long-term cash flows of renewable energy assets. It also gives Innergex the flexibility to scale globally without the constraints of public market scrutiny.

However, integration risks remain, especially across such a diverse technology portfolio, and regulatory oversight could intensify for cross-border asset transfers

Why It Matters:

Signals investor confidence in RE cash flows

Syndication includes Québec and Swiss institutional investors

Innergex gains agility to scale globally

🧨 Risk Box:

Integration risks across hydro, wind, solar, and BESS

Regulatory scrutiny in cross-border asset transfers

⚙️ Technology

🔋 Tesla’s Solid-State Leap

Tesla has unveiled a prototype solid-state battery that could redefine the future of energy storage. With an energy density of 450–600 Wh/kg, 800A charging capability, and over 4,000 charge cycles, this battery promises 700–1,000 km of EV range and full charging in under 10 minutes.

It also eliminates thermal runaway risk, making it significantly safer than current lithium-ion technologies. The battery uses fewer rare and toxic materials, improving sustainability and reducing supply chain vulnerabilities. While the invention marks a major leap forward, challenges remain in scaling production and securing a reliable supply of solid electrolytes.

Tesla’s new solid-state battery boasts:

450–600 Wh/kg energy density

800A charging

4,000+ cycles

Zero thermal runaway risk

Why It Matters:

Enables 700–1,000 km EV range

10-minute full charge potential

Safer, longer-lasting, and cheaper to produce

🧨 Risk Box:

Mass production hurdles remain

The solid electrolyte supply chain still immature

💡 Innovation

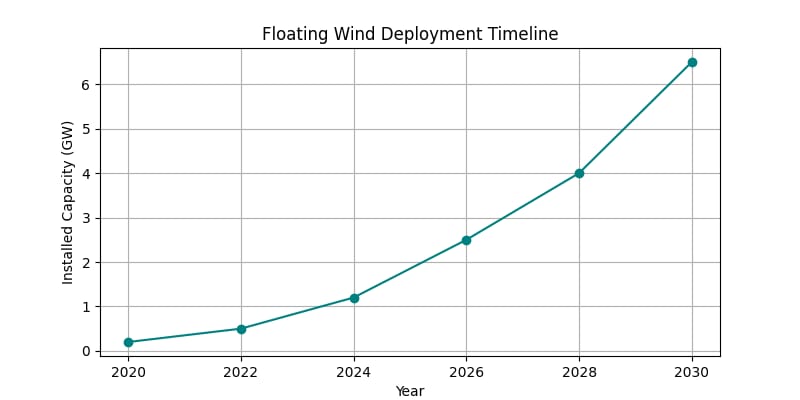

🌊 Floating Wind Deployment Timeline

Floating wind is no longer a fringe technology. Global capacity is expected to reach 2.5 GW by 2030, with 27.3 GW already under construction. China leads the offshore wind race with 42.9 GW, followed by the UK at 15.6 GW.

Floating platforms are particularly valuable for deep-water sites where fixed-bottom turbines are not feasible. They also reduce seabed disruption and can be paired with offshore hydrogen production.

However, the sector faces high capital costs, long permitting timelines, and complex offshore logistics. As technology matures and costs fall, floating wind could become a cornerstone of global decarbonization strategies.

Why It Matters:

Unlocks deep-water wind potential

Floating platforms reduce seabed disruption

Key to decarbonizing island and coastal grids

🧨 Risk Box:

High capex and long permitting cycles

Offshore logistics and maintenance complexity

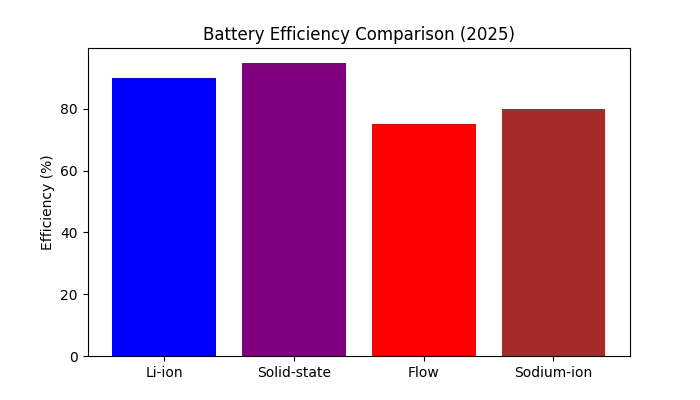

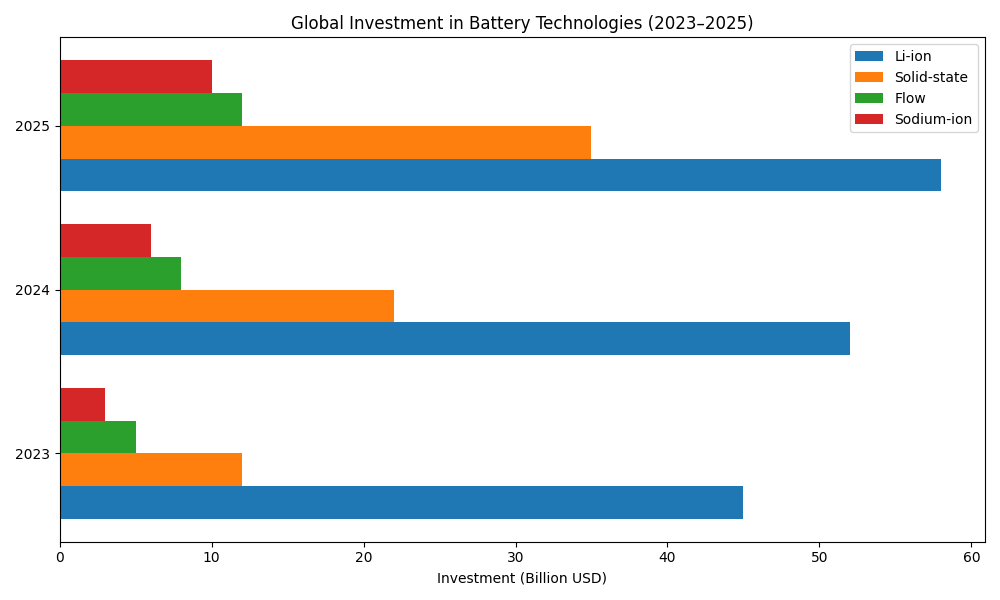

📈 Chart of the Week: Global Investment in Battery Technologies (2023–2025)

🔍 Editor’s Note:

Battery storage has emerged as a prominent feature. This chart tracks global investment across four major battery technologies over the past three years: Li-ion, solid-state, flow, and sodium-ion. While Li-ion remains dominant, solid-state batteries are seeing explosive growth, nearly tripling in investment from $12B in 2023 to $35B in 2025. Flow and sodium-ion technologies are also gaining traction, especially for grid-scale applications and long-duration storage

📚 Interesting Reads

🔋 Tesla, BYD & CATL Are Making Batteries for Solar Power

Examine how leading battery manufacturers are leveraging solar intermittency through advanced storage systems.

👉 Read on Energy Digital🌊 bp & JERA’s Offshore Wind Partnership

This collaboration, valued at $10 billion, aims to scale offshore wind energy in Asia and Europe, specifically focusing on floating platforms and grid integration.

👉 Read on Energy Digital⚡ Google & Brookfield’s 3 GW Hydroelectric Deal

A major tech-energy partnership aimed at decarbonizing data centers and enhancing grid resilience.

👉 Read on Energy Digital🌞 Amazon’s Sustainability Strategy with Renewables

Amazon is reducing its emissions per sales dollar by investing in solar, wind, and nuclear energy.

👉 Read on Energy Digital🔬 Solid-State Batteries: Why They’re Big News

A deep dive into the science, promise, and challenges of solid-state batteries—and why they’re gaining traction globally.

👉 Read on TechXplore📈 Indonesia’s 320 GWh Distributed Battery Plan

A bold initiative to deploy solar mini-grids and battery storage across 80,000 villages.

👉 Read on ESS News🏗️ India’s 2 GWh BESS Tender in Rajasthan

A major opportunity for developers to bid on grid-connected battery storage systems.

👉 Read on ESS News🌍 Sermatec Secures 430+ MWh Storage Project in Bulgaria

Chinese tech is reshaping Europe’s green energy landscape with large-scale deployments.

👉 Read on ESS News🧪 Sumitomo’s Flow Battery for AI-Led Smart Grid Trial in Japan

A pioneering project combining flow batteries with AI for smarter energy management.

👉 Read on ESS News📊 Renewable Energy Project Tracker & Insights

Stay updated on global PPAs, equipment orders, and capacity expansions across all clean energy technologies.

👉 Read on Renewables Now