Hi, Watt Wizards!

Welcome to the 34th edition of “Renewable Insights ”, your compass in the ever-evolving world of sustainable energy.

What can we expect in this edition?

🌍 Surge in European Power Purchase Agreements: Trends and Key Developments in 2024

🌪️ Nordex Dominates the German Onshore Wind Market in 2024

🔋 Avina Clean Hydrogen Advances Renewable Hydrogen Project in Texas

🌞 Uruguay Launches Tender for 75 MW Solar Park

🔬 Saudi Arabia Unveils Its Largest Battery Energy Storage System

Read previous editions here: https://muxenergy.beehiiv.com/

What’s Trending?

1. Nordex Dominates the German Onshore Wind Market in 2024

Nordex has secured the top position in the ranking of German onshore wind installations for 2024, leading the market with a significant

number of commissioned turbines. Key Highlights:

Leading Position: Nordex installed 196 turbines with a total capacity of 1.06 GW, achieving a market share of 32% of newly-connected onshore wind power in Germany.

Competitors: Following Nordex, Enercon and Vestas ranked second and third, while GE Vernova and Siemens Gamesa placed fourth and fifth, respectively, indicating a substantial gap between them and the top three.

Future Outlook: Karsten Brüggemann, Nordex's Vice President for the central region, expressed optimism about continued growth in 2025, citing a strong order intake and numerous new installations expected due to their technology's suitability for the German market.

This performance underscores Nordex's strong foothold in the renewable energy sector in Germany as it continues to lead in onshore wind installations.

2. China Surpasses 70GW in Battery Energy Storage Capacity

China has surpassed 70GW of installed Battery Energy Storage System (BESS) capacity, with stable prices for DC blocks.Key Highlights

Installed Capacity: China has surpassed 70GW of installed BESS capacity, with a total of 78.3GW/184.2GWh of "new energy storage" capacity reported by the end of 2024.

Market Dominance: BESS now exceeds pumped hydro capacity in the country, marking a significant shift in energy storage solutions.

Recent Installations: In 2024 alone, 43.7GW/109.8GWh of new energy storage was added, bringing the total installed capacity across all energy storage technologies to 137GW.

Lithium-Ion Batteries: The majority of the installed capacity is based on lithium-ion technology, although alternative technologies like sodium-ion and vanadium redox flow batteries are being developed.

Competitive Pricing: Recent procurement tenders show competitive pricing for BESS, with bids ranging from US$60-82 per kWh, averaging around US$66.3 per kWh.

Stable DC Block Prices: Despite significant growth and competition in the energy storage sector, DC block prices remain stable overall, as evidenced by a separate tender from PetroChina reflecting similar price ranges.

These highlights underscore China's leadership in the energy storage market and the ongoing advancements in battery technology and pricing stability.

3. Poland's Offshore Wind Ambitions: Paving the Way for Leadership in the Baltic Sea

Poland is advancing its offshore wind capabilities, aiming to become a leader in the Baltic Sea region. The completion of two substations for the "Baltic Power" project marks the beginning of commercial-scale offshore wind development in Poland. This initiative is part of a broader plan to achieve 5.9 GW of offshore wind capacity by 2030, which could cover over 50% of the country's electricity demand.

Key highlights:

Project Significance: The "Baltic Power" offshore wind farm is set to be commissioned in 2026, providing approximately 3% of Poland's current electricity demand.

Economic Impact: The project is expected to create tens of thousands of jobs and significantly benefit local economies, with Polish companies contributing about 20% of the total investment.

EU Presidency Priorities: The kick-off coincides with Poland's Presidency of the Council of the EU, emphasizing energy security and industrial competitiveness as key priorities.

Future Vision: The upcoming "Clean Industrial Deal" aims to enhance Europe's industrial competitiveness through renewable energy expansion.

This development underscores Poland's commitment to renewable energy and its role in enhancing energy security within Europe.

4. The Future of Wind Energy in Europe: Challenges and Opportunities for Growth

Europe currently derives **20% of its electricity** from wind energy, but the construction of new wind farms is lagging significantly behind targets. In 2024, Europe added 15 GW of new wind capacity, with only 13 GW coming from onshore sources and 2.3 GW from offshore. This is far below the 30 GW per year needed to meet the EU's energy goals for 2030.

Key Challenges

1. Permitting Issues: Many EU countries have not yet implemented the new EU permitting rules, which are designed to streamline the approval process for new wind projects. This has resulted in a worsening situation in 2024, despite successful examples like Germany, which permitted nearly 15 GW of new onshore wind—seven times more than five years ago.

2. Grid Connection Delays: Access to the electricity grid is now the primary bottleneck for deploying wind energy. Over 500 GW of potential wind capacity is awaiting grid connection assessments, with significant projects like the 900 MW Borkum Riffgrund 3 offshore wind farm in Germany facing delays until at least 2026.

3. Slow Electrification: The pace of electrification in Europe is insufficient; currently, only 23% of energy consumed is electricity, which needs to rise to 61% by 2050. The European Commission is working on an Electrification Action Plan to address this issue.

Addressing permitting delays, enhancing grid connections, and accelerating electrification will be crucial for Europe to meet its ambitious renewable energy targets and ensure energy security moving forward.

5. Surge in European Power Purchase Agreements: Trends and Key Developments in 2024

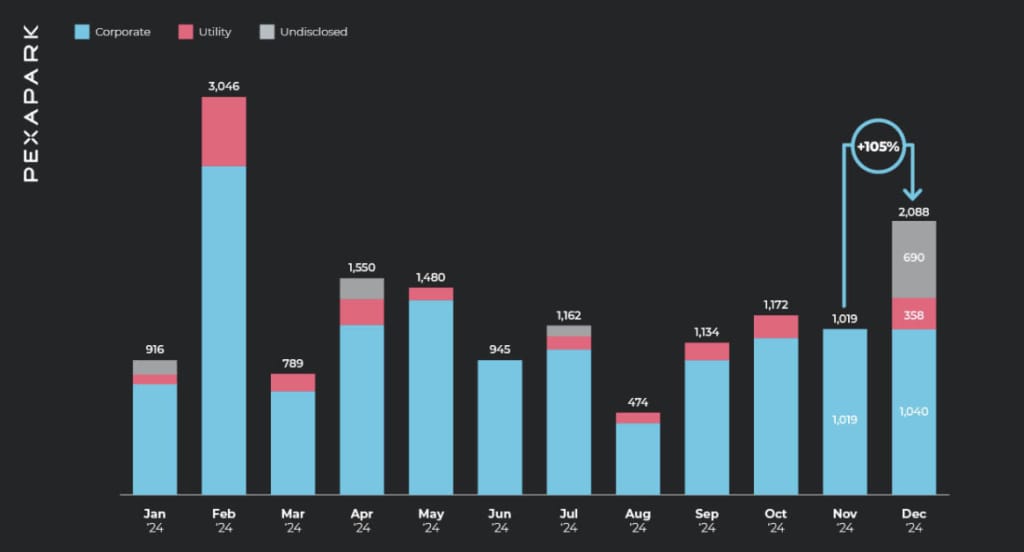

In December 2024, Europe experienced a significant surge in power purchase agreements (PPAs), with over **2 GW** contracted, marking it as the second strongest month of the year for such deals. According to Swiss consultancy Pexapark, 27 separate agreements were recorded, including a record nine utility PPAs, as major players aimed to finalize contracts before the year's end.

Key Highlights:

Notable Deals: Among the prominent agreements was a ten-year solar PPA between Recurrent Energy, a subsidiary of Canadian Solar, and an undisclosed US technology company. This deal involves purchasing power from the 300 MW Tordesillas PV project located in Valladolid, Spain.

PPA Trends: The analysis indicates that while December was strong, the overall PPA landscape in 2024 saw a decrease in the size of deals compared to 2023. The largest PPA in 2024 was 596 MW, down from 869 MW in the previous year.

Diverse Technology Spread: The distribution of technologies in PPAs became more balanced in 2024. While solar energy dominated PPA volumes in 2023 (accounting for 80%), onshore wind gained traction this year.

Largest Solar PPA: The largest solar-specific PPA of 2024 was a 350 MW, 20-year agreement between GreenYellow and Carrefour in France. This deal is unique as it involves energy sourced from multiple distributed solar canopies installed above Carrefour's car parks throughout the country.

Pexapark plans to release a comprehensive analysis of the entire year's PPA activity soon, which will provide further insights into these trends and developments.

Projects & Mergers!

1. Oxan Energy Secures Estonia's First Floating Offshore Wind Project: The Saare 1 Initiative

Oxan Energy, a French offshore wind developer, has secured Estonia's first floating offshore wind project through a partnership with financial advisor SNOW.The 'Saare 1' project, located 60 km off the coast of Saaremaa island, will have a potential capacity of 900 MW in waters up to 85 meters deep.

Project Details:

The consortium will conduct environmental and technical studies, starting with an environmental impact assessment, to determine whether to use floating wind technology exclusively or combine it with bottom-fixed installations. The final layout decision hinges on these studies, with commissioning expected by 2033.

Key features:

Location: 88 km² zone in the Baltic Sea

Energy output: Enough to power approximately 900,000 households

Strategic alignment: Supports Estonia’s target of 100% renewable electricity by 2030

Technical Considerations

The water depth range (up to 85 meters) makes this project particularly suited for testing hybrid wind farm configurations. Floating turbines typically operate in depths exceeding 60 meters, while fixed-bottom structures are more common in shallower waters.

2. Avina Clean Hydrogen Advances Renewable Hydrogen Project in Texas

Avina Clean Hydrogen is making significant progress on its renewable hydrogen project in Texas. The Texas Commission on Environmental Quality has issued a final air permit for the facility, overcoming critical environmental and regulatory challenges.This milestone is part of Avina's broader commitment to advancing renewable fuel technologies and facilitating the transition to a low-carbon economy.

Key Developments

Technology Partner: Avina has selected KBR to provide ammonia synthesis technology for the project.

Offtake Contracts: Long-term contracts for 100% of phase one production output were signed in 2022 with an unnamed customer.

Final Investment Decision (FID): Expected in the first half of 2025, with plans to complete two phases by 2028.

Pre-Certification: The facility has secured pre-certification under the EU's Renewable Fuels of Non-Biological Origin (RFNBO) standards and achieved Tier 1 status in South Korea’s Clean Hydrogen Pre-Certification program, boasting a carbon intensity score of 0.04 kgCO₂e/kgH₂.

Infrastructure Plans

The ammonia produced will be transported via pipeline directly to the Port of Corpus Christi for export, eliminating the need for road or rail transport and minimizing public exposure.

3. Uruguay Launches Tender for 75 MW Solar Park

Uruguay's power utility, UTE, has initiated a tender for a new **75 MW solar park** known as the **Melo solar project**, to be located near the city of Melo in the Cerro Largo department. This project will feature approximately 138,000 solar panels, each with a capacity between 650 W and 750 W.

Project Details

Location: Near Melo, Cerro Largo department

Land Area: 2.12 square kilometers (currently undergoing expropriation)

Bidding Timeline: Tender closing in January 2026

Construction Start: Expected in March 2026

Operational Date: Between March and June 2028

Investment Context

UTE has committed to a $100 million investment in solar parks, with completion expected between 2025 and 2027. The solar capacity will be distributed across two sites, with 25% on UTE land in San José and 75% in northern Uruguay. As of the end of 2023, Uruguay had approximately 297 MW of installed photovoltaic capacity, according to the International Renewable Energy Agency (IRENA).

Technology & Innovation

1. Saudi Arabia Unveils Its Largest Battery Energy Storage System

Saudi Arabia has successfully commissioned its largest battery energy storage system (BESS) in Bisha, marking a significant advancement in the country's renewable energy efforts. This facility boasts a capacity of 500 MW/2000 MWh, making it the world's largest operational single-phase energy storage project.

Project Highlights

Location: Bisha, ‘Asir province, Saudi Arabia

Ownership: Saudi Electric Company (SEC)

Technology Provider: The system includes 122 prefabricated storage units supplied by China’s BYD, each integrating a 6 MW power conversion system and four lithium iron phosphate (LFP) battery modules with a total capacity of 5.365 MWh.

EPC Consortium: The project was developed by a consortium of the State Grid Corporation of China and Riyadh-based Alfanar Projects.

Additionally, Saudi Arabia is pursuing further large-scale battery storage projects, with the Saudi Power Procurement Company (SPPC) currently tendering for four additional 500 MW/2,000 MWh BESS projects, attracting interest from major players like Masdar, ACWA Power, EDF, and TotalEnergies.

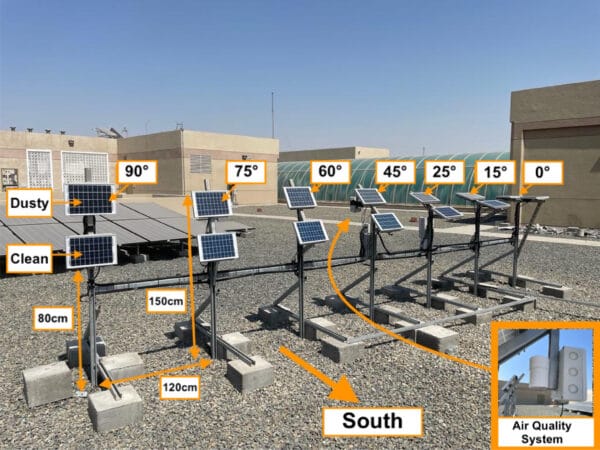

2. Best Tilt Angles for Dusty Environments Revealed in Jeddah Study

A research collaboration between scientists from Saudi Arabia and the United Kingdom has revealed critical insights into the performance of photovoltaic (PV) modules in Jeddah City, one of the world's most challenging environments for solar energy due to severe dust accumulation.The year-long study focused on the impact of dust and tilt angles on solar panel efficiency, highlighting how environmental factors such as rain intensity, sandstorms, and cloud cover affect energy output.

Key Findings

Experimental Setup: The study utilized seven pairs of PV modules installed at various tilt angles (0°, 15°, 25°, 45°, 60°, 75°, and 90°) in a desert environment. One panel in each pair was cleaned daily, while the other accumulated dust.

Performance Metrics: Over the year, it was found that dust accumulation could reduce power output by up to 80.4% after prolonged dry periods for panels at a 0° angle. The 25° angle performed best overall, with a median production of 4.76 W, while other angles produced lower outputs.

Impact of Rain: Rain played a significant role in cleaning the panels, especially those at steeper angles. However, low rainfall intensities (<1 mm/day) led to increased dust adhesion on flat panels.

Optimal Tilt Angle

The study concluded that a tilt angle of 25° is optimal for maintaining higher energy production in dusty conditions, while 45° was found to be more effective during rainy periods. These findings provide valuable guidelines for enhancing solar panel efficiency and longevity in desert environments.

The results were published in the journal Solar Energy, emphasizing the importance of understanding environmental patterns to improve solar energy systems in regions prone to severe soiling challenges.

Key Takeaways

🤝 Nordex has secured the top position in the ranking of German onshore wind installations for 2024

📈 Europe currently derives **20% of its electricity** from wind energy

Saudi Arabia has successfully commissioned its largest battery energy storage system (BESS)

🚀Avina Clean Hydrogen is making significant progress on its renewable hydrogen project in Texas.

💡 Uruguay's power utility, UTE, has initiated a tender for a new **75 MW solar park** known as the **Melo solar project**