Hi, Watt Wizards!

Welcome to the 30th edition of “Renewable Insights ”, your compass in the ever-evolving world of sustainable energy.

What can we expect in this edition?

🌍 Johnson & Johnson Achieves 100% Renewable Electricity for European Operations

🌪️ Strategies of Chinese Wind Turbine Manufacturers in the European Market

🔋 EDPR Exits Colombian Wind Projects

🌞Iberdrola Secures €100 Million Green Loan from EIB to Build Solar Plant in Sicily

🔬 BNEF Forecasts Significant Drop in Green Hydrogen Prices by 2050

Read previous editions here: https://muxenergy.beehiiv.com/

What’s Trending?

1. Johnson & Johnson Achieves 100% Renewable Electricity for European Operations

This accomplishment is part of the company's broader commitment to reach global renewable electricity for all its operations by 2025.Key Highlights:

Operational Reach: The transition to renewable energy affects Johnson & Johnson's sites across 12 European countries, including Belgium, France, Germany, Greece, Ireland, Italy, the Netherlands, Poland, Spain, Sweden, Switzerland, and the United Kingdom.

Renewable Energy Projects : This milestone was facilitated by three virtual power purchase agreements finalized in 2021, which led to the construction of two wind farms and one solar field in Spain. These projects contribute a total generation capacity of 104 megawatts (MW), producing approximately 270,000 megawatt hours (MWh) of renewable electricity annually.

Previous Achievements : Before reaching this milestone, Johnson & Johnson sourced about 79% of its electricity in Europe from renewable sources. The company has been utilizing hydropower in Greece, Sweden, and Germany since 2018 and offshore wind energy in Belgium and the Netherlands since 2020.

Marianne Gries, Director of EMEA Sustainability at Johnson & Johnson, expressed pride in the company's progress toward its climate goals and emphasized the importance of these new energy projects in accelerating the transition to renewable energy in Europe.

2. Strategies of Chinese Wind Turbine Manufacturers in the European Market

Chinese wind turbine manufacturers are increasing their market share in the European Union due to several driving factors:1. Cost Advantage: Chinese manufacturers can produce wind turbines at significantly lower costs, often about one-fourth the price of European counterparts. This pricing strategy allows them to offer competitive bids for projects in Europe, making their products attractive to developers seeking cost-effective solutions to meet renewable energy targets.

2. Technological Advancements: Continuous improvements in technology have led to enhanced efficiency and reliability of Chinese turbines. In 2023, prices for Chinese turbines dropped by over 30%, further solidifying their competitive edge in the market.

3. Strong Domestic Market Growth: The robust growth of the wind power sector in China has provided manufacturers with the scale and experience necessary to compete internationally. This domestic demand has enabled significant investments in technology and production capabilities.

4. Strategic Export Initiatives: Chinese companies are actively pursuing international markets, with exports of wind turbines and components to Europe reaching approximately $1.42 billion last year. Their strategic focus on Europe is part of a broader effort to establish a global footprint similar to what was achieved in the solar energy sector.

5. Urgent Need for Renewable Energy in Europe: The EU's ambitious climate goals necessitate rapid expansion in renewable energy capacity, creating an opportunity for Chinese manufacturers to fill the gap with affordable turbine options. The EU aims for 42.5% renewable energy use by 2030, driving demand for competitively priced solutions.

6. Dependence on Chinese Components: Many European manufacturers rely heavily on components from China, such as blades and gearboxes, which constitute a significant portion of Europe's wind power supply chain. This reliance complicates efforts for European firms to compete solely on price without engaging with Chinese suppliers.

7. Government Support and Policies: The Chinese government has implemented policies that support the wind industry through subsidies and incentives, allowing manufacturers to maintain competitive pricing while expanding their global presence.

3. Iberdrola Secures €100 Million Green Loan from EIB to Build Solar Plant in Sicily

Iberdrola has signed a €100 million green loan agreement with the European Investment Bank (EIB) to finance the construction of a photovoltaic plant in Sicily, Italy.Project Overview:

Loan Amount: €100 million (approximately $103 million).

Location: The solar plant will be situated in the provinces of Enna and Catania, Sicily.

Capacity: The plant will have a capacity of 242.78 MWp, which is expected to supply renewable energy to around 154,000 households.

Operational Date: The facility is projected to commence operations in 2025.

Financial Details:

The EIB's financing will cover 70% of the project costs, backed by SACE’s Archimede guarantee, which provides market-based guarantees for financing and bonds for up to 25 years.

This partnership marks the first collaboration between Iberdrola and the EIB under the Archimede guarantee scheme.

Significance:

This initiative aims to enhance renewable energy production in Italy and support the European Union's climate goals.

The project is expected to contribute significantly to Italy's energy transition while also creating job opportunities in local communities.

4. EDPR Exits Colombian Wind Projects: Strategic Withdrawal Amid Financial and Operational Challenges

EDPR (Energias de Portugal Renováveis) decided to exit its troubled wind projects in Colombia, specifically the Guajira plans.1. Delays and Uncertainty: The projects faced significant delays and ongoing uncertainty, which hindered their progress and viability. These issues made it increasingly difficult for EDPR to justify continued investment in the region.

2. Financial Impact: The exit from these projects is expected to result in a financial hit of approximately $700 million. This substantial loss reflects the challenges and risks associated with the Colombian market, particularly in relation to regulatory and operational hurdles.

3. Strategic Re-evaluation: EDPR's decision appears to be part of a broader strategic re-evaluation of its investments in regions where the operational environment is fraught with difficulties. By withdrawing from these projects, EDPR aims to focus on more promising opportunities that align better with its growth objectives.

4. Market Conditions: The overall market conditions in Colombia, including regulatory challenges and competition, may have contributed to the decision to withdraw from these specific projects.

In summary, EDPR's exit from its Colombian wind projects was driven by delays, financial risks, and a strategic shift towards more viable investments.

5. BNEF Forecasts Significant Drop in Green Hydrogen Prices by 2050

Bloomberg NEF (BNEF) has revised its forecast for the future price of green hydrogen, predicting a significant drop from current prices ranging between $3.74/kg and $11.70/kg to between $1.60/kg and $5.09/kg by 2050. This adjustment reflects higher-than-expected costs for electrolyzers, which are critical for hydrogen production.

Key Insights:

Price Adjustments: BNEF has more than tripled its cost estimate for green hydrogen by 2050 due to anticipated increases in electrolyzer costs, indicating that green hydrogen will remain more expensive than previously projected for several decades.

Regional Competitiveness: The report suggests that only countries like China and India are likely to achieve cost-competitive green hydrogen with gray hydrogen by 2040, where the cleaner fuel will reach a price comparable to its fossil fuel counterpart.

Investment Activities: In related news, Hydrogen Pro has secured approximately NOK 70 million ($6.14 million) in new equity through a private placement and signed an investment agreement with Longi Hydrogen. Additionally, Green Hydrogen Systems has completed a reduction in its nominal share capital and secured a short-term loan facility to support operations.

This updated outlook underscores the challenges facing the green hydrogen sector, particularly in achieving cost parity with traditional hydrogen sources in the near term.

Projects & Mergers!

1. Rosatom to Establish Wind Turbine Blade Manufacturing Facility in Russia

Russia's state nuclear corporation, Rosatom, is set to establish a facility for manufacturing wind turbine blades at a former Vestas plant in the Leningrad region. Key details:

Location: The new manufacturing facility will be located at the site of a former Vestas production plant, which has been dormant since 2020.

Production Capacity: Rosatom aims to produce blades with a length of up to 80 meters, which are essential for modern onshore and offshore wind turbines.

Investment and Goals: The project is part of Rosatom's broader strategy to diversify its energy portfolio and contribute to Russia's renewable energy goals amid increasing global interest in wind energy.

Timeline: The company plans to start production by 2025, marking a significant step in enhancing domestic capabilities for wind energy infrastructure.

Implications:

This initiative by Rosatom highlights Russia's efforts to expand its renewable energy sector, particularly in wind power, as the country seeks to reduce its reliance on fossil fuels and embrace more sustainable energy sources. The establishment of this facility could also provide local job opportunities and stimulate economic growth in the region.

2. AM Green Ammonia Signs MoU with RWE

AM Green Ammonia (AMG) has signed a Memorandum of Understanding (MoU) with RWE to supply renewable ammonia from its production facilities in India.Key details:

Supply Volume: AMG will provide up to 250,000 tons of renewable ammonia annually. The supply will be divided, with 20% coming from the Kakinada site and 80% from the Tuticorin facility.

Energy Sources: Both production sites will utilize a combination of wind, solar, and hydroelectric power to produce ammonia that meets the EU standards for Renewable Fuels of Non-Biological Origin (RFNBO).

Compliance Certification: The Kakinada site has been pre-certified for RFNBO compliance by CertifHy, while certification for the Tuticorin facility is in progress.

Operational Timeline: The AMG plants are expected to commence operations by 2027.

Production Capacity

The Kakinada project is designed for an initial capacity of 250,000 tons per year, with plans for expansion. At full capacity, the Kakinada and Tuticorin sites will produce 2 million tons and 1 million tons of renewable ammonia annually, respectively.

Strategic Importance

RWE aims to enhance its investments in hydrogen and low-carbon derivatives to assist industries in achieving climate goals.

The collaboration highlights AMG's innovative approach to contracting and its position as a leader in the clean energy transition, focusing on low-cost green molecules like hydrogen and ammonia.

This agreement represents a significant step towards advancing the production and utilization of renewable ammonia, contributing to global efforts in sustainable energy solutions.

3. ABB to Acquire Gamesa Electric's Power Electronics Business

ABB has signed an agreement to acquire the power electronics business of Gamesa Electric from Siemens Gamesa.Key Details of the Acquisition

Acquisition Overview: ABB, a Swedish-Swiss multinational conglomerate, is set to enhance its capabilities in power electronics by acquiring Gamesa Electric's business, which specializes in technologies critical for renewable energy applications.

Location: The acquisition involves Gamesa Electric's operations based in Spain.

Strategic Importance: This move is part of ABB's strategy to strengthen its position in the renewable energy sector, particularly in power electronics and energy storage solutions, which are essential for integrating renewable sources into the energy grid.

Implications

Market Positioning: By integrating Gamesa Electric's technology and expertise, ABB aims to enhance its product offerings and competitive edge in the growing renewable energy market.

Focus on Sustainability: The acquisition aligns with ABB's commitment to sustainability and its goal of advancing the transition to a low-carbon economy through innovative solutions.

This acquisition is expected to bolster ABB's capabilities in power electronics, further supporting its initiatives in renewable energy and energy efficiency.

4. NuVision Solar to Launch 2.5 GW HJT Solar Manufacturing Facility in U.S

A new solar manufacturing company, NuVision Solar, has announced plans to establish a facility in the U.S. with an impressive 2.5 GW annual production capacity for solar cells and modules. Here are the key details:

Key Details

Technology: The factory will focus on manufacturing Heterojunction (HJT) solar cells, which are known for their high efficiency and performance.

Product Offering: NuVision Solar aims to produce bifacial solar modules with power outputs of up to 800 W. The products will come with a 35-year performance warranty and a 20-year product warranty.

Job Creation: The new facility is expected to create approximately 500 direct jobs in the region.

Production Timeline: Initial module production is anticipated to begin in the fourth quarter of 2025.

Strategic Advantages

Domestic Content Requirements: NuVision's products will comply with domestic content requirements, allowing customers to qualify for an additional 10% bonus under the Inflation Reduction Act.

Innovative Technology: The company's zero busbar interconnection technology enhances connectivity and reduces common issues like microcracking and hotspots, improving overall module reliability.

This initiative marks a significant step forward in bolstering domestic solar manufacturing capabilities and supporting the transition to renewable energy in the United States.

Technology & Innovation

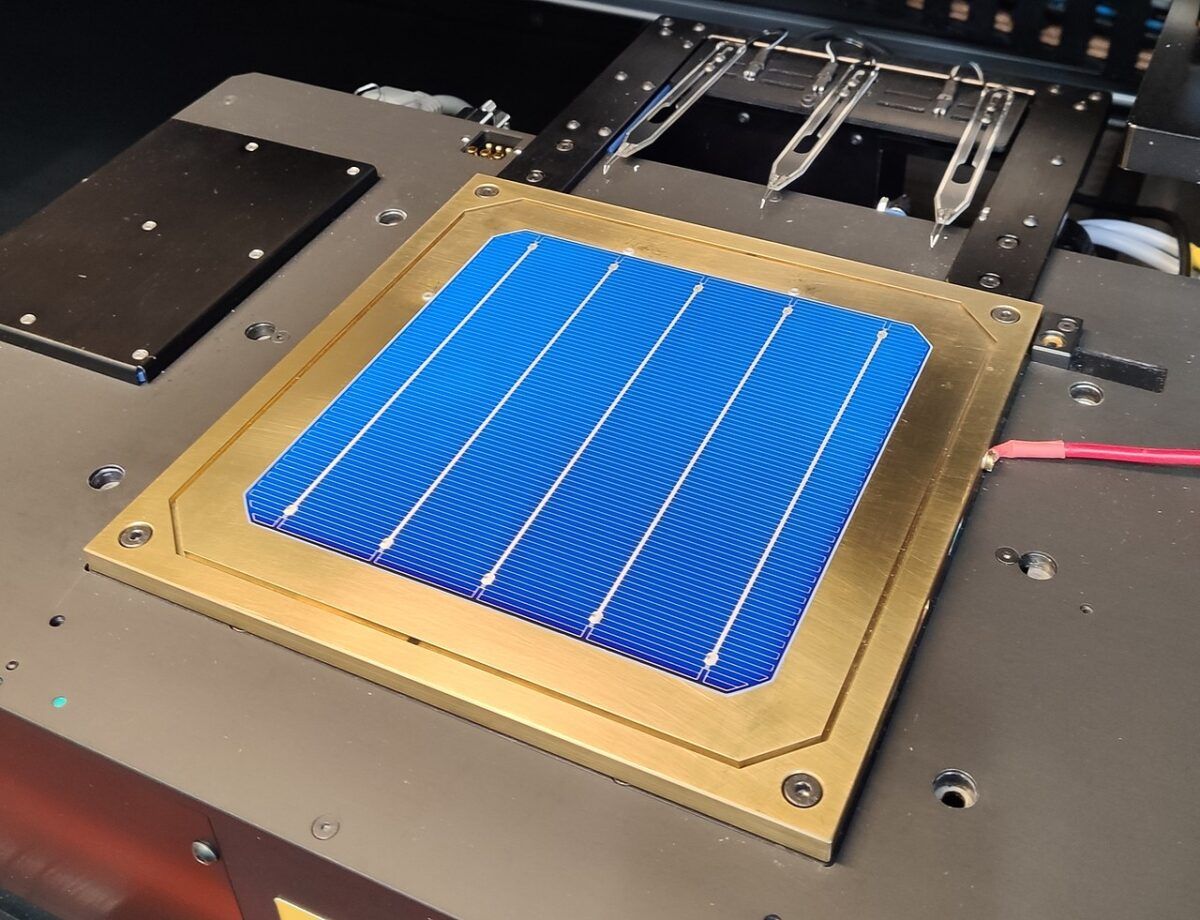

1. NexWafe Achieves 24.4% Efficiency for Heterojunction Solar Cells

NexWafe GmbH has announced a significant milestone in solar technology by achieving a power conversion efficiency of 24.4% for a heterojunction (HJT) solar cell made with its ultrathin wafers.Key Details:

Efficiency Achievement: The impressive efficiency was reached using an unspecified M6 HJT commercial production line, although it is not confirmed whether this result has been certified by an independent third party.

Innovative Manufacturing Process: NexWafe's direct gas-to-wafer process serves as a full replacement for traditional Czochralski (CZ) wafers. This approach offers substantial cost savings by reducing material losses and energy consumption by 40%, while also eliminating the need for the saw damage etching process typically required in cell production.

Material Advantages: The EpiNex wafers produced through this method have an oxygen content that is 20 times lower than conventional CZ wafers, enhancing thermal stability and overall cell performance.

Tandem Cell Development: In collaboration with the Swiss Center for Electronics and Microtechnology (CSEM), NexWafe has developed a perovskite-silicon tandem solar cell that achieved a remarkable 28.9% efficiency.

Environmental Impact:

NexWafe's innovative production process not only improves efficiency. The company claims that its manufacturing method can lower wafer production costs by up to 30% and decrease carbon dioxide emissions during manufacturing by 70%.

Future Plans

NexWafe is set to commission its new epitaxial facility in Bitterfeld, Germany, by June 2025. This facility will utilize advanced heating systems and atmospheric pressure chemical vapor deposition to produce monocrystalline silicon over large areas, enhancing scalability in manufacturing.

This advancement positions NexWafe as a key player in the solar industry, potentially enabling module producers to achieve higher efficiencies without needing to upgrade their existing production lines.

Key Takeaways

🤝 ABB has signed an agreement to acquire the power electronics business of Gamesa Electric from Siemens Gamesa

📈 AM Green Ammonia (AMG) has signed a Memorandum of Understanding (MoU) with RWE to supply renewable ammonia from its production facilities in India.

Rosatom is set to establish a facility for manufacturing wind turbine blades

🚀 NuVision Solar has announced plans to establish a facility in the U.S. with an impressive 2.5 GW annual production capacity for solar cells

💡 Iberdrola has signed a €100 million green loan agreement with the European Investment Bank (EIB)