Hi, Watt Wizards !

Welcome to the 20th edition of “Renewable Insights ”, your compass in the ever-evolving world of sustainable energy.

What can we expect in this edition?

🔧 RWE Collaborating with Mingyang

💡 SolarPower Europe's Call for Enhanced Cybersecurity

💚 Masdar to Expand Green Bond Issuance

💰 South Korea Wins Czech Nuclear Reactor Project

⚡France Awards 1GW in Latest Onshore Wind Round

📊 Global Electricity Demand Forecast

Read previous editions here:https://muxenergy.beehiiv.com/

What’s Trending?

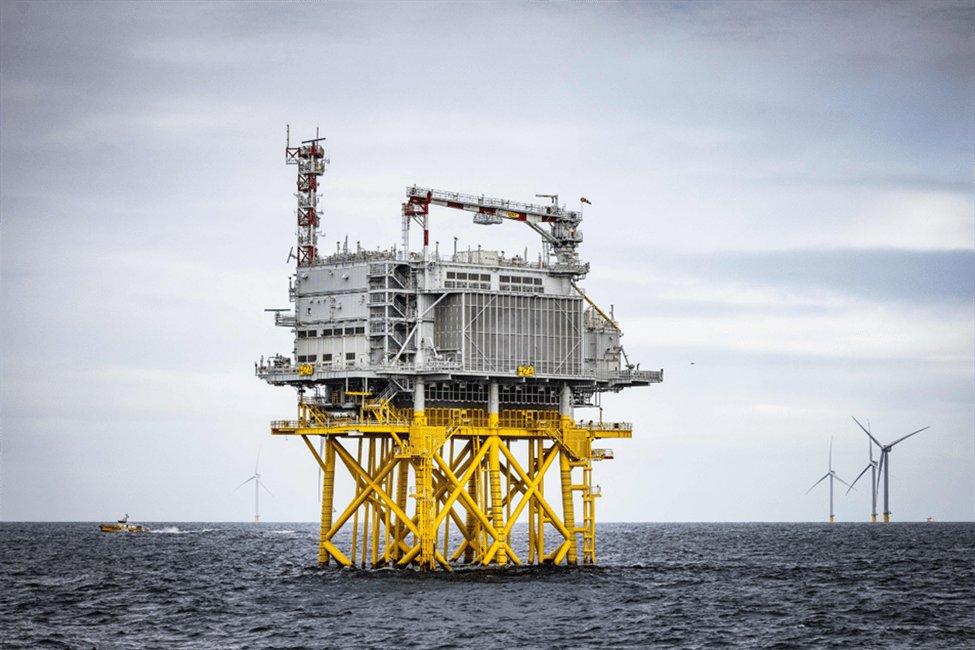

1.RWE Collaborating with Mingyang

Collaborating with Mingyang presents several potential benefits for RWE, particularly in the context of expanding its offshore wind capabilities.

Key Details:

Access to Advanced Technology: Mingyang has established itself as a leader in offshore wind technology, having developed the world's largest wind turbines, including the MySE 16-260 model. This collaboration could provide RWE with access to cutting-edge turbine technology, enhancing the efficiency and output of their offshore projects.

2.Strengthening Supply Chains: RWE is currently focused on developing European supply chains. By partnering with Mingyang, RWE can tap into the established and robust Chinese supply chain, which has successfully built and commissioned significant offshore wind capacity.

3.Cost-Effectiveness: The partnership may allow RWE to leverage competitive pricing and innovative technologies that reduce overall project costs, which is crucial in a rapidly evolving energy market.

4.Innovation and Sustainability: The partnership could foster innovation in offshore wind technologies, particularly in developing safer and more cost-effective solutions.

Overall , the collaboration with Mingyang could significantly benefit RWE by providing access to advanced technologies, strengthening supply chains, opening new market opportunities, reducing costs, and fostering innovation in the renewable energy sector.

2.SolarPower Europe's Call for Enhanced Cybersecurity

SolarPower Europe has called for enhanced cybersecurity measures within the solar sector, highlighting the need for a harmonized cybersecurity baseline in response to increasing cyberattack threats.

Recommendations for Cybersecurity

SolarPower Europe emphasizes the importance of establishing a sector-specific cybersecurity framework.

The organization suggests that while the current risk of cyberattacks on solar installations is limited, future attacks could lead to significant issues such as data theft, operational disruptions, and instability in the electricity system.

Data Security Measures

Operational data from solar power plants should remain within the EU or in regions with comparable security standards.

Mandatory best practices for large power plants and security layers for monitoring commands in distributed energy systems are advocated.

Small-scale photovoltaic (PV) users and installers are encouraged to enhance device cybersecurity through strong passwords and regular software updates.

Economic Benefits of Digital Flexibility

Implementing digital flexibility solutions could save the solar sector €32 billion ($34.9 billion) by 2030 and €160 billion by 2040.

Investing in cybersecurity is crucial for realizing these financial benefits.

3. Global Electricity Demand Forecast

According to the IEA's Electricity Mid-Year Update, global electricity demand is forecast to grow by around 4% in 2024 and 2025, representing the highest annual growth rate since 2007. This increase is driven by robust economic growth, intense heatwaves, and the increasing uptake of technologies like EVs and heat pumps.

Key highlights:

Renewable sources of electricity are set to expand rapidly, with their share of global electricity supply forecast to rise from 30% in 2023 to 35% in 2025.

Solar PV alone is expected to meet roughly half of the growth in global electricity demand over 2024 and 2025, with solar and wind combined meeting as much as three-quarters of the growth.

Despite the sharp increases in renewables, global power generation from coal is unlikely to decline this year due to strong growth in demand, especially in China and India.

India's electricity demand is expected to surge by 8% this year, driven by strong economic activity and powerful heatwaves.

China is set to see significant demand growth of more than 6%, as a result of robust activity in the services industries and various industrial sectors, including the manufacturing of clean energy technologies.

The European Union will see a more modest recovery in electricity demand, with growth forecast at 1.7%, following two consecutive years of contraction amid the impacts of the energy crisis.

This emphasizes the need to expand and reinforce grids to provide secure and reliable electricity supply, as well as implement higher energy efficiency standards to reduce the impacts of increased cooling demand on power systems.

4. Vattenfall Stays Positive!

Vattenfall was able to maintain profits in Q2 2024 despite lower electricity prices by selling offshore wind farm projects.

Key Points:

Vattenfall completed the sale of its Hollandse Kust Zuid 1-4 offshore wind project in the Netherlands, which contributed to strengthening the company's financial position.

In Q1 2024, Vattenfall also completed the sale of the Norfolk Offshore Wind Zone in the UK, reporting a capital gain of SEK 4.6 billion.

In Q2 2024, Vattenfall signed an agreement to sell 49% of the Nordlicht 1 and 2 offshore wind farms in the German North Sea to BASF.

These divestments of offshore wind assets helped offset the impact of lower electricity prices on Vattenfall's generation business.

While electricity prices declined across Vattenfall's markets in Q2 2024 due to factors like lower fuel prices and increased wind and solar generation, the company's underlying operating profit still increased by 23% in the first half of the year.

Overall, Vattenfall's Q2 performance reflects a strategic pivot towards asset management and renewable energy investments, reinforcing its market position amid fluctuating electricity prices.

5. Growatt's Growth in Europe's C&I Solar and Storage Markets

Growatt is experiencing growth in Europe’s Commercial and Industrial (C&I) solar and storage markets, despite some challenges in the broader market. The company's strategy involves focusing on C&I storage applications while also tapping into Germany's DIY solar market.

Key points:

Market Dynamics: While Growatt has shipped approximately 20 GW of inverters in the past year, European market growth has not met expectations due to falling electricity prices, the end of subsidies, and economic pressures like high inflation.

Emerging Trends: There is a growing trend among businesses to combine solar and storage solutions, driven by high electricity prices and supportive policies in various countries.

New Product Launch: Growatt has introduced a new C&I storage system featuring a hybrid inverter with an output power rating between 30 kW and 100 kW, which can support various battery capacities.

Market Expansion: Although the C&I energy storage market in Germany is expanding, it remains relatively small.

Overall, Growatt is positioning itself to capitalize on the evolving C&I solar and storage landscape in Europe, adapting its offerings to meet changing market demands.

Projects & Mergers!

1. France Awards 1GW in Latest Onshore Wind Round

France has awarded 1GW of capacity in its latest onshore wind tender. The tender, which closed in June 2024, saw 1,004MW awarded to 71 projects across 13 regions of France.

Key details from the tender results:

Total Capacity : 1,004MW awarded out of 1,200MW on offer.

Number of Projects : 71 projects selected.

Average Price : €65.7/MWh

Lowest Price : €58.5/MWh

Highest Price : €74.5/MWh

The awarded projects are expected to generate enough electricity to power the equivalent of 1.6 million homes.

This latest tender is part of France's broader efforts to expand its onshore wind capacity to meet its renewable energy targets.

The results demonstrate continued investor interest in France's onshore wind market, despite some challenges such as permitting delays and public opposition in certain regions.

The competitive pricing also suggests that onshore wind is becoming increasingly cost-effective compared to other generation sources in France.

2. South America Poised for Onshore Wind Expansion: Capacity Set to Double by 2030

South America is projected to double its onshore wind capacity over the next ten years, as reported by Wood Mackenzie. The region is expected to see significant growth in wind energy deployment, driven by favourable policies, increasing demand for renewable energy, and advancements in technology.

Key points :

Capacity Growth : South America is anticipated to increase its onshore wind capacity significantly, with investments expected to reach around $18 billion by 2030.

Leading Countries: Brazil and Argentina are identified as the primary drivers of this growth, with Brazil alone expected to add approximately 15 GW of new onshore wind capacity.

Market Dynamics: The growth in onshore wind is supported by a combination of government incentives, competitive bidding processes, and a shift towards cleaner energy sources to meet climate goals.

Challenges: Despite the positive outlook, the region faces challenges such as regulatory hurdles infrastructure limitations, and the need for improved grid integration to accommodate the increasing share of wind energy.

Overall, the forecast indicates a robust expansion of onshore wind energy in South America, positioning the region as a key player in the global renewable energy landscape.

Source: wood-mackenzie

3. Envision Energy and Saudi PIF Form Joint Venture

Envision Energy, a leading green technology company, has announced a strategic joint venture (JV) with Saudi Arabia's Public Investment Fund (PIF) and Vision Industries. The partnership aims to drive the growth of wind power throughout the Middle East and support Saudi Arabia's goal of localizing 75% of renewable energy components by 2030.

Key highlights of the JV:

Manufacturing and Assembly: The JV will focus on manufacturing and assembling wind turbines and components, including blades, nacelles, and hubs.

Shareholding : Envision Energy holds the majority share, while PIF and Vision Industries hold the remainder.

Localization : The collaboration supports Saudi Arabia's National Renewable Energy Program, which aims to localize renewable energy components by 2030.

Expertise : PIF chose Envision as its JV partner due to the company's leading position in green power technologies, including smart wind power, energy storage systems, and green hydrogen solutions.

Vision : The partnership brings together PIF's investment capabilities and Envision Energy's wind power technology, highlighting international cooperation and a shared vision for the clean energy transition.

This strategic alliance marks a significant step towards Saudi Arabia's Vision 2030 objectives and advances global efforts in achieving a sustainable future.

4. Masdar to Expand Green Bond Issuance

Abu Dhabi's Masdar has announced plans to issue more green bonds after successfully raising $1 billion in its recent offering. This move is part of Masdar's strategy to finance its renewable energy projects and support sustainable development initiatives.

Key points :

Successful Issuance : The $1 billion green bond issuance received strong demand from investors, highlighting the growing interest in sustainable financing.

Use of Proceeds : Funds raised will be allocated to various renewable energy projects, including solar and wind initiatives, aligning with Masdar's commitment to expanding its clean energy portfolio.

Future Plans : Masdar aims to leverage the momentum from this successful issuance to explore further opportunities in the green bond market, reinforcing its position as a leader in sustainable finance.

This initiative underscores Masdar's dedication to promoting renewable energy and its role in advancing the UAE's sustainability goals.

Technology & Innovation

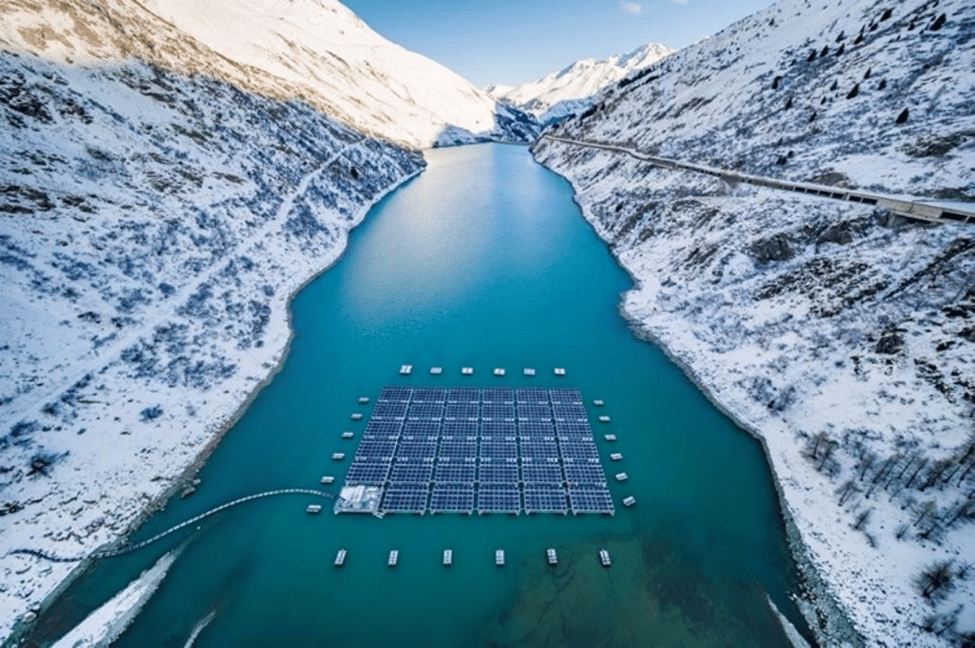

1. High-Altitude Floating Solar System

The world's first high-altitude floating photovoltaic (PV) system, installed on Lac des Toules in the Swiss Alps (Switzerland) has been found to have an energy payback time of just 2.8 years. This 448 kW system, built by Romande Energie, consists of 35 platforms with bifacial PV panels covering 2% of the lake's surface.

Key findings from Zurich University of Applied Sciences include:

Environmental Impact : The high-altitude floating PV installation emits approximately 94 g CO2-equivalent per kWh of electricity produced over its life cycle, demonstrating lower environmental impacts compared to conventional systems.

Energy Yield : The system benefits from higher energy yields and reduced land use, although its mounting systems, requiring significant aluminium, contribute to environmental impacts.

Recommendations for Improvement : The researchers suggest reducing aluminium usage in mounting systems, utilizing recycled materials, or exploring alternative materials to enhance environmental performance and reduce costs.

This study contributes valuable insights into the environmental performance of floating PV systems at high altitudes and identifies opportunities for improving sustainability in this emerging technology.

Upcoming Events & Conferences

Key Takeaways

🚀 Collaborating with Mingyang presents several potential benefits for RWE, particularly in the context of expanding its offshore wind capabilities.

🌿 South Korea's state-owned Korea Hydro & Nuclear Power Co. has been chosen to build two multibillion-dollar nuclear reactors in the Czech Republic

☀️ The world's first high-altitude floating photovoltaic (PV) system, installed on Lac des Toules in the Swiss Alps (Switzerland) has been found to have an energy payback time of just 2.8 years.

🌊 France has awarded 1GW of capacity in its latest onshore wind tender.

⚡ Abu Dhabi's Masdar has announced plans to issue more green bonds after successfully raising $1 billion in its recent offering.